2018: The Year That Was

And how I fared on my predictions from last year

And how I fared on my predictions from last year

As you might remember, I wrote a post for the first time last year predicting the state of the markets we operate in for the year of 2018. It’s time that I analyse how I fared on these predictions.

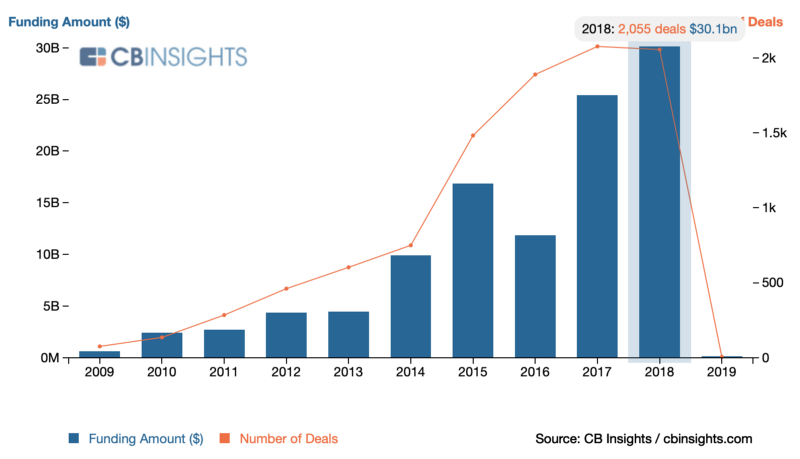

Let’s start with aggregate data for 2018. Venture investments across Indonesia, Singapore, and India were up by ~20% to cross $30B. The number of deals however were slightly down at ~2000 deals, implying bigger deal sizes in 2018.

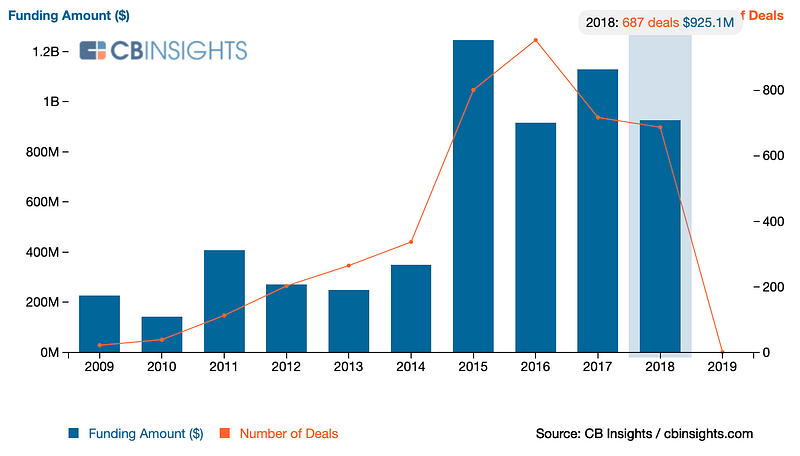

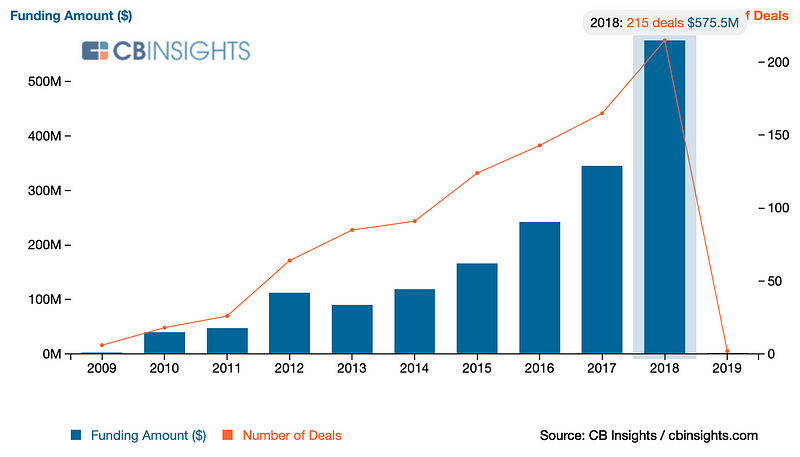

Early stage rounds (Seed, Series A, Convertible Notes) in each of these markets are showing an interesting phenomena. When you break up the early stage financing across these geographies, Southeast Asia is seeing a huge spurt and India is flat or declining in both the number of deals and overall funding amount. It shows that the investor enthusiasm is pretty high for Southeast Asian internet market given its younger state of development, whereas Indian investors are still recovering from 2015–16’s hangover.

And now going back to some of the predictions I made for 2018, by dividing them into Fact, Fiction, and Unproven (yet):

India — 2018

1. For the early stage, strong companies will be built from all the learnings of previous failures in 2016–2017, and 2018–19

Unproven, but I do believe it’s a Fact.

I have seen much more focus on fundamental value in entrepreneur pitches than just copy-cat models. But this is a bit difficult to objectively judge at this point, we’ll have to look back on this in the next few years.

2. For the later stage, the power will consolidate further among 2–3 startups

Fact.

It’s quite clear that e-commerce war in India is a two-horse race between Amazon and Flipkart. Walmart acquiring Flipkart was a major reason for cheer in the Indian startup ecosystem last year, and it will settle the two companies as winners in the long run.

For payments, while there is a lot of new entrants such as Google Tez and even Whatsapp, the market share is still predominantly held by PayTM and PhonePe overall on digital payments. UPI was a second black-swan movement in India, and that has led to some shakeout before the eventual winners get decided for the Payments ecosystem.

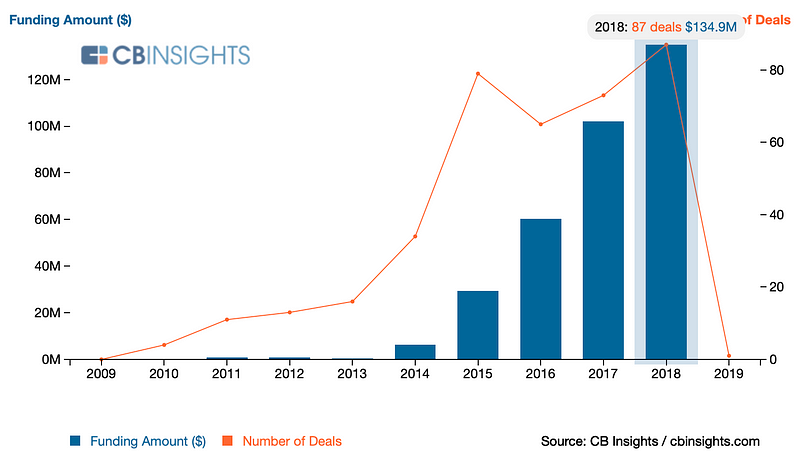

Singapore — 2018

1. Singapore is likely to become a hotbed for AI-focused companies as well as blockchain-economy

Fact.

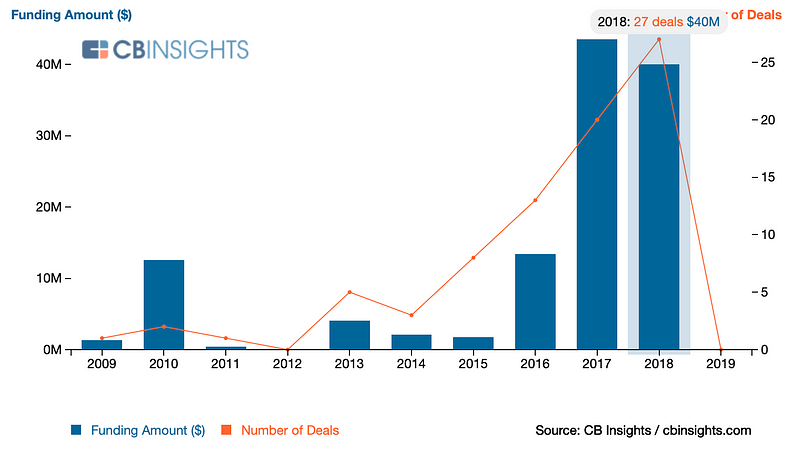

Singapore has definitely taken a lead in the region for AI-focused companies. There were 27 early stage deals led by investors in Singapore in 2018 which revolved around AI and Machine Learning. This spurt was mostly led by two organizations: Entrepreneur First and SGInnovate.

What is even more surprising is that almost a similar number of blockchain-based companies got funded, despite the whole bust of cryptocurrencies. Also interesting to see that the investor base for these companies is highly fragmented

Indonesia — 2018

1. 2018 is when clear winners will start emerging in each vertical and the losers will fall on the sides

Unproven.

While this is starting to happen in e-commerce with the reported shutdown of Matahari Mall but the e-commerce marketplace sector still has multiple big players such as Lazada, Tokopedia, Bukalapak, and Shopee. 2018 was not when the market consolidated to 2–3 players.

Similarly in ride sharing, while Uber was acquired by (merged with?) Grab, we haven’t yet come to the conclusion on who is the eventual winner of the sector between Grab or Go-Jek.

2. We’ll also likely see a lot of early-stage acquisitions by these same unicorns

Unproven.

Again, while Go-Jek has acquired numerous companies in the last 12 months, the other unicorns are still in a build-over-buy approach.

Summarising, I was mostly right about India, bang-on for Singapore, and luke-warm for Indonesia predictions. Well let me try to do a better job now for the 2019 predictions in my next post. Stay tuned.