2019 — The Year that was

And how I fared on my predictions from last year

And how I fared on my predictions from last year

Just like last year, I’ll start this year with a post on looking back at 2019 and especially at my predictions from the start of the year. But before, we begin, an overall state of venture economy in our region.

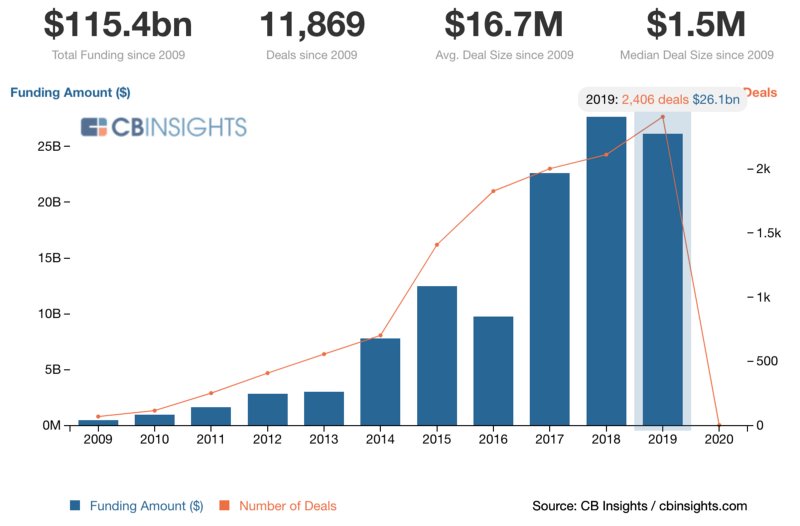

Focusing on India, Indonesia, and Singapore, the VC community was almost as busy in 2019 as it was the year before. With over 2000 deals, VCs deployed $26B into these emerging markets, that’s a massive amount. Despite this, there was a slight drop in overall deployment, driven largely by late stage investors (read Softbank). I will allude this drop to Softbank being busy with issues in other markets, as well as running close to the end of investments period on its first Vision fund.

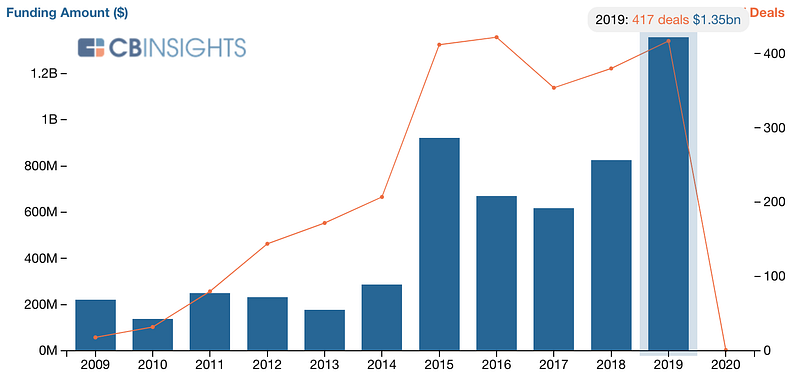

In the early stage though, normalcy returned. Starting with India, and focusing on Seed to Series A rounds, India saw a massive increase in investment amount crossing $1B for the first time, with a substantial increase in deal sizes especially at Series A. This was driven largely by global funds such as Tiger Global, Lightspeed, and Accel deploying huge amounts in proven category leaders at a very early stage. As you might notice, avg deal size increased in 2019, a trend that has been continuing for some years now. This corresponds to what we see on ground, where a typical Seed round is $1M+ now in the market.

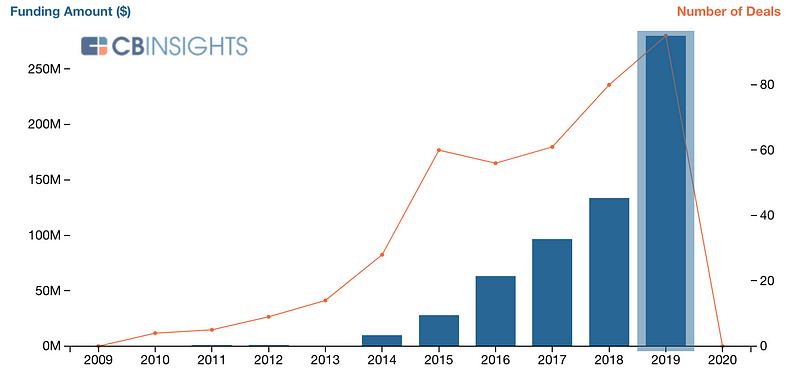

Meanwhile, Singapore continued its upward trajectory in early stage deployment, again with slightly increased average deal sizes. Quite a few of these had a government-backed institution involvement, either as an incubator or as a co-investor. The deployment was mostly focused on deep-tech and enterprise sectors.

Lastly, Indonesia saw the largest increase in early stage deployment, led by significantly larger deal sizes in 2019. Venture Capital poured in from all directions, but a bulk of this was driven by local funds who have raised fresh capital in the market in the last year.

And now going back to some of the predictions I made for 2019, marking them into Fact, Fiction, and Unproven (yet):

India — 2019

1. Modi will win the elections, but this time it will be a close call…with the government enacting new e-laws, making life especially difficult for foreign entities to operate in India

Fact.

Modi did win the elections, however by a huge margin, which was unexpected for me. On the government regulating foreign (and domestic) entities hard, I was bang on.

2. In the late stage startups, we are likely to see at least 5 new unicorns emerge, this time in sectors previously untapped such as SaaS and Healthcare

Fact.

India saw 7 new unicorns emerge in 2019, with 5 of them from B2B sector and 2 from logistics

3. Meanwhile the power will continue to consolidate in category leaders in each segment

Unproven.

While most category leaders did end up becoming decacorns in their own segment (Oyo in Travel, PayTM in Fintech), their leadership has been built around capital-as-a-moat strategy. This has given ability to other startups and enterprises to challenge the market dominance and the jury is still out on the soaring valuations of these companies.

4. This will also be a great time for new early stage funds to mark their presence and rise above the ashes. Series B and C stages will continue to attract attention from foreign funds, both from US and China. All in all I expect the early stage ecosystem to grow, but slightly…

Fact.

There were many new entrants in the early-stage ecosystem including 100x, Better Capital, and Inflection Point Ventures. Growth-stage ecosystem also saw the likes of Tiger Global and Chinese funds invest heavily into companies. The growth in investments overall was quite significant, compared to my original prediction.

Singapore — 2019

1. The government will continue on its current track to support deep tech initiatives which would focus on AI and automation, with Blockchain as a secondary priority

Fact.

Most of the investments in Singapore belong to deep-tech categories including AI with heavy involvement from government institutions including SGInnovate, AStar, Enterprise SG, and EDBI.

2. We’ll continue to not have many (growth stage investments) for a few years till the ecosystem finds its way.

Fact.

There was a dip in overall investment deployment in Series B+ stage of venture capital. Most of the money still goes to regional players domiciled in Singapore. The early-stage deep-tech investments are yet to mature to warrant large cheques.

3. In the early stages, the market will continue to grow in a healthy pace with Seed funds being happy to deploy into freshly minted AI companies, while leveraging on government schemes and funds

Fact.

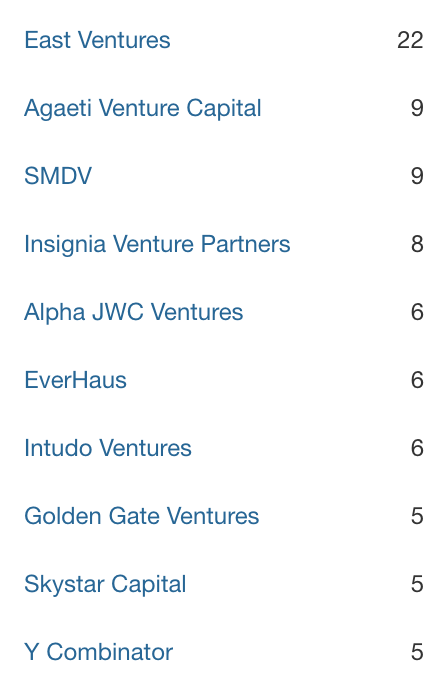

The top 6 investors (by number of deals) in early-stage last year are all deploying in deep-tech sectors now, driven by the government’s mandate to help develop this sector.

Indonesia — 2019

1. Jokowi will have a resounding win in the elections. The path for the digital economy creation will get clearer and even more weight will be thrown by the state.

Fact.

Jokowi did see a resounding win in the elections. The push for digital economy internally is higher than ever, with the President’s cabinet including Nadiem Makarim and creation of a tech founder’s advisory committee.

2. Grab and GoJek will be the largest tech behemoths fighting it out in the region and becoming even more horizontal by way of acquisitions. The war will still be held on the grounds of ride-sharing, on-demand services and fintech

Fact.

These are the only two companies in Southeast Asia to reach decacorn initiatives. The war is indeed being fought on the verticals I mentioned. Meanwhile, other companies such as Tokopedia and LinkAja have started partnering with the duopoly.

3. In the early stages, we’ll see a barrage of new local funds being established, with capital both from domestic corporates and families.

Fact.

Many new funds were setup in 2019 for the early-stage investments, with a majority of the most active investors being funded by domestic capital.

4. Series B stage will see the maximum amount of capital deployment, mostly from foreign funds, especially those from China

Fiction.

I was very wrong on this one. There were around 10 total number of deals in Series B stage in Indonesia in 2019. Compare that with around 100 that happened in India. Clearly the foreign funds are currently busy with deployments in India, and feel that Indonesia startup economy’s maturity is a few years away.

Overall I was mostly right with my predictions except that Indian investment growth and lack of the same in the growth stage in Indonesia took even me by surprise. And with this, let’s shift our focus on the decade to come in my following post.