Building a ₹10,000 Cr B2B marketplace in India

What animal are you chasing?

What animal are you chasing?

A few days ago, I had a chat with an LP who is looking into the Indian B2B market for the first time. His question to me was simple:

“Do you believe that a large enough business can be built by charging subscriptions to Indian SMBs?”

My answer was simple:

“No”

But a moment ago I had explained how we are investing heavily into the Indian B2B market targeting the SMBs, explaining why this market is so hot, why Messrs Scott Shleifer, Masayoshi Son et. al. are dumping hundreds of millions of dollars on the market and why India B2B products are no longer restricted to Global SaaS businesses but also businesses targeting Indian SMB. So how do the two statements add up?

I don’t see companies building a significantly large subscription businesses targeting the Indian SMB market. But the SaaS-enabled marketplace business model is often overlooked by those not investing in the Indian SaaS category. And this is the gold mine that a handful of investors are searching for.

I am not alone in saying this. As you read, massive companies are being built by exceptional founders in the Indian B2B category taking this exact approach. But instead of building a $100M subscription revenue businesses from Global SMB/Enterprise, their goal post is different:

How to get to a ₹10,000 Cr Revenue business?

Why this arbitrary ambitious target? If you look at recent IPOs on the National Stock Exchange (see Dixon Technologies) or even NASDAQ, crossing a ₹1,000 Cr revenue mark usually equates to a $1B valuation. But in the age of billion dollar fund sizes (see Tiger Global’s latest fund of $6.7B fund or Sequoia India’s latest funds of $1.35B), a Unicorn valuation doesn’t cut it any more, it’s the age to build a Decacorn.

As a general rule of thumb, an Indian B2B marketplace businesses ends up with 10–20% take-rates. A ₹10,000 Cr Revenue business can end up yielding ₹2,000 Cr of Gross Margin and (hopefully) at steady state at least ₹500 Cr of EBITDA. At a conservative 30x EV/EBITDA this would yield a company worth ₹15,000 Cr or $2B. But at an inflated tech multiple of 100x, ~$10B.

Hello, Decacorn 👋

Before you say, making ₹10k Cr Revenues as a B2B marketplace is not likely in India, take a look at some benchmarks:

Flipkart is currently doing ₹30,000 Cr+ revenues in India. Amazon is currently doing ₹10,000 Cr+ revenues in India, and even Zomato crossed ₹11,000 Cr in gross order value in FY20.

So if it’s possible in B2C, why not in B2B, especially those serving SMEs, which are a backbone of the country and the largest contributor to the Indian economy?

The evolution of Bharat SaaS

So how do B2B startups aim to hit this coveted ₹10,000 Cr revenue target? The answer is simple, you build stickiness through a tech product (SaaS or otherwise), but layer a marketplace on top to drive the revenue.

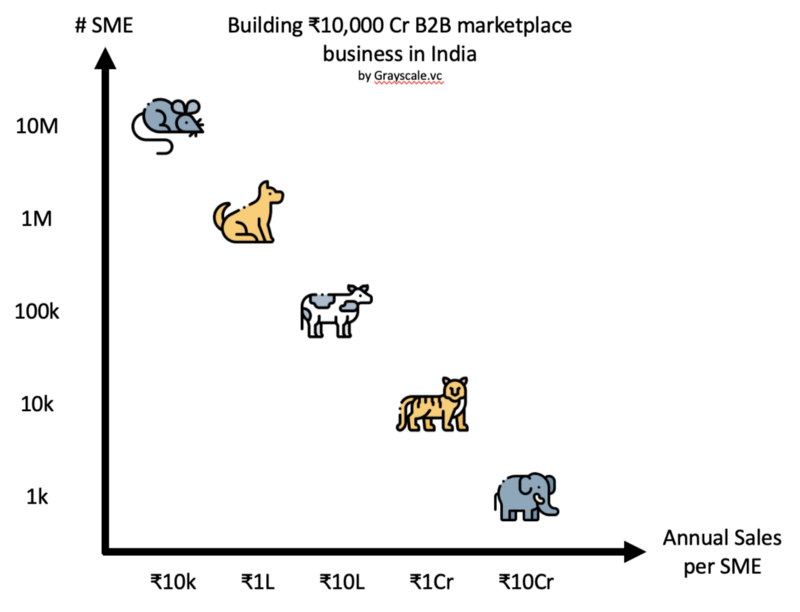

In a manner akin to the SaaS animals chart by Christopher Janz, but modified to suit the Indian B2B context, we get something like this:

To figure out where you need to sit on the map, evaluate the number of potential customers in your industry, take a general rule of 10–30% market penetration, and see how much annual sales per customer you need to be passing through your platform. Similar to how ACV (annual contract value) is ultra-important in SaaS businesses, Annual Sales per SME is super important in a B2B marketplace business.

Note, when I say SME as a customer, I’m talking about the Buyer in the marketplace, not the Seller.

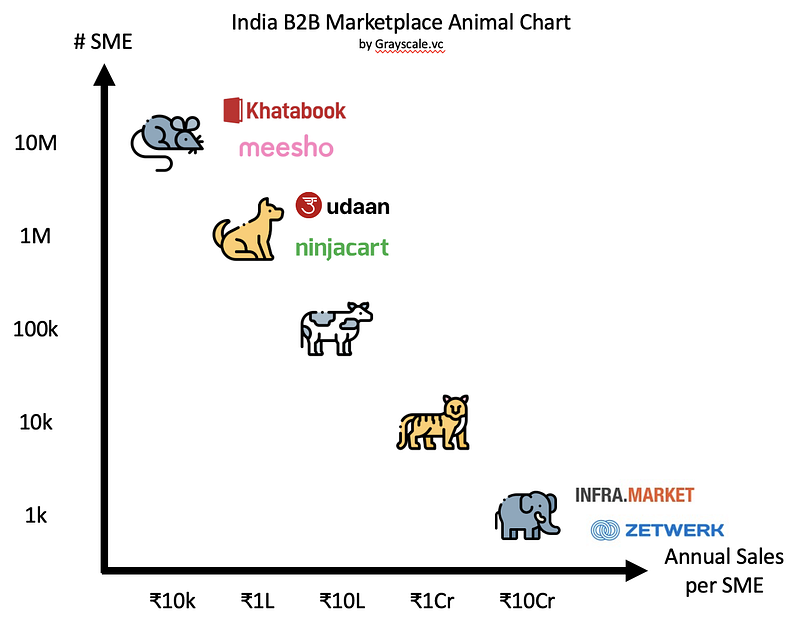

Placing some of the larger, well known B2B marketplace startups in India on this chart:

Khatabook — a digital book-keeping app. The company already claims 20M registered users, but it is yet to figure out a proper monetisation strategy. Whether the strategy is payments, commerce, or lending — the company will need to make at least ₹10,000 per customer per year to build a sizeable business

Meesho — a social-commerce platform. The company is already having 10M+ resellers (micro SMEs) on its platform, and passes through ₹7,000 Cr GMV of goods through its platform

Udaan —a wholesale trading platform. The company claims to have more than 1M SMEs onboard, and a ₹15,000 Cr+ GMV

Ninjacart — a fresh foods supply chain platform. The company claims to have more than 100k retailers buying ~₹1L of goods per year, giving it a ₹1,000 Cr+ GMV

Infra Market —a construction material marketplace. The company primarily sells construction material to infrastructure projects and transacts with over 1000+ contractor-SMEs, and currently at ₹3,000 Cr+ GMV run-rate

Zetwerk — a contract manufacturing marketplace. The company is transacting with 250+ customers globally, mostly mid-sized enterprises, and is hovering around ₹3,000 Cr+ GMV

While Khatabook and Meesho are busy chasing the micro-SMEs (housewife-resellers and home-store Kiranas), the likes of Udaan and Ninjacart are out hunting the mid-sized traders, wholesalers, and retailers. Meanwhile Infra Market and Zetwerk are out riding Elephants — the large-sized enterprises in the market

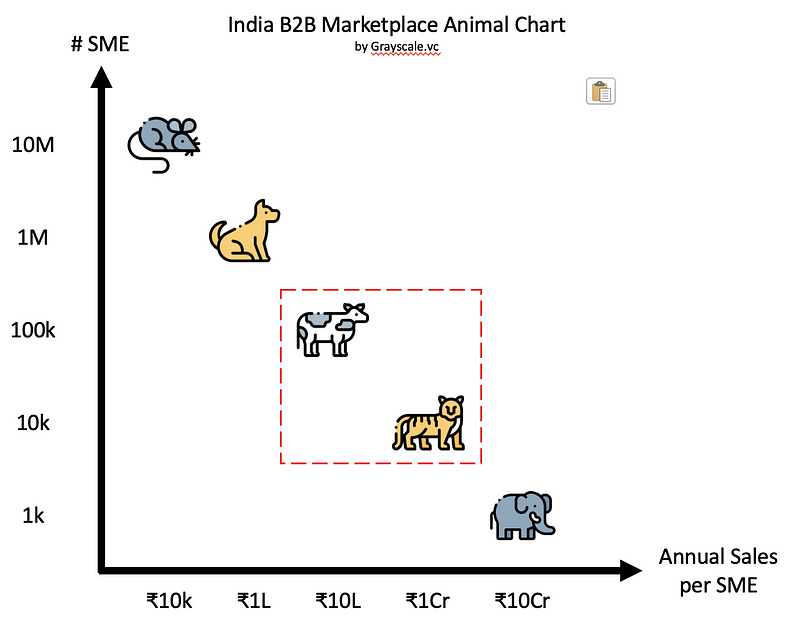

I’m sure by now you have noticed an important factor in the image. The missing middle!

While the first set of startups (Meesho, OkCredit, Khatabook, Udaan…) that gained traction in the B2B space were targeting the bottom of the pyramid — the second set of companies (Infra Market, Zetwerk) came in and started targeting the top of the pyramid. This allowed them to grow quickly, much faster than their smaller-animal counterparts.

At STRIVE we truly believe that the next set of scaled-up companies are likely to emerge from — you guessed it — the missing middle…

This means startups targeting the thousands of mid-sized SMBs, making upto a crore per year in sales per customer, by linking goods, services, or customer leads to these SMBs are likely to be the next emerging category of winners in B2B marketplaces.

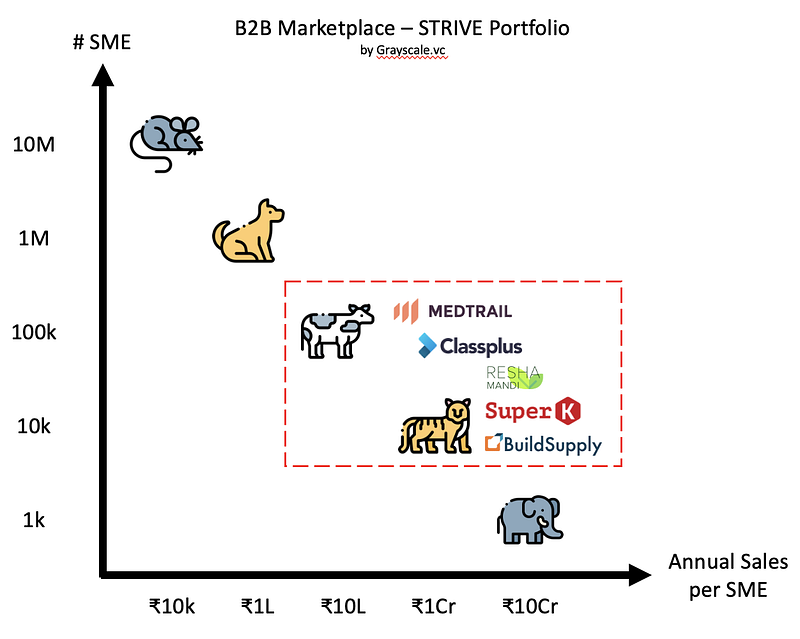

Already, within our portfolio we are seeing the growth of this category with Classplus, ReshaMandi, Medtrail, SuperK, BuildSupply, with each of them doing business in the range of ₹10L to ₹1Cr with their B2B SME buyer in industries with 100k-1M SMEs.

As a fund, we are spending an inordinate amount of time on the Cows and Tigers category of companies. Using the playbook of our SaaS GTM learnings from global markets, modifying them to suit the local Indian context, we have seen our portfolio come up with exciting approaches to target, acquire, and onboard these SMEs onto their platforms. As you move into the business of targeting the Cows and Tigers, the approach towards sales acquisition and customer identification changes significantly.

In the next few months, my team and I will try to distill some of these approaches, and hopefully if you’re a founder building in this space, you will come forward and share yours!