Camp Blue or Camp Red?

And how partnerships are working in Southeast Asia

And how partnerships are working in Southeast Asia

Lately I am coming across a lot of startups who are claiming having partnerships with one of the existing tech giants in the ecosystem and hence I decided to write a post around the topic.

We are at a point in Southeast Asia where the tech giants (henceforth called gorillas, just because) have raced ahead to achieve huge scale. As a result of their scale, these gorillas want to dabble their toes in almost every business that they see becoming a part of their product portfolio in the future, and sometimes they are willing to work together with a small partner for this initial experimentation. This is a double edged sword for the young startups as on one hand they can leverage the magnificent scale of their partners, in some cases even resulting in an acquisition opportunity, but on the other hand the startups risk losing their small territory to the gorillas if its interesting enough for them.

It’s a risk and you should take it based on what your competitive advantages are over the gorillas.

Southeast Asia has attracted a lot of attention this year. Last year was spent grappling through the downturn, every one took their foot off the accelerator and decided to simply sit back and stare outside the window at the landscape. However, this year the race seems to be back on again. Partly due to the Chinese dragons entering the market. And partly due to American cowboys announcing their ambitions for capturing a share of the pie. Why does all of this matter to a small fledgling startup? Should you care if Alibaba beats JD to invest in Tokopedia? Does it matter whether Grab wins the transport market or GoJek does?

You should and it does.

Any startup grows with the help and support of the ecosystem. And the ecosystem is developed more by the gorillas in the market than even by the investors.

1. Gorillas can be aggressive and can compete ruthlessly. It becomes easier to predict future strategies of the gorillas if you keep a close eye on the sector landscape

2. Gorillas will often pick the help of younger companies for expanding into these new territories. You need to be on their radar when they are out recruiting their troops. Further if you join one Camp you will automatically distance yourself from opposing Camps in the market

3. Most of your partnership decisions will get deeply impacted by who is playing in what territory. The question in every gorilla’s mind is always build vs buy vs partner and you should be in a position of strength with enough internal capabilities to shift their focus away from the first option

4. Your future financing options will likely be decided by which gorilla has better relationships with whom. If you are partnering with one of the gorillas and they are funded by investor X, be sure that you will get introduced to Ms. X willingly or unwillingly. Your data will also be an open book for Ms. X to read

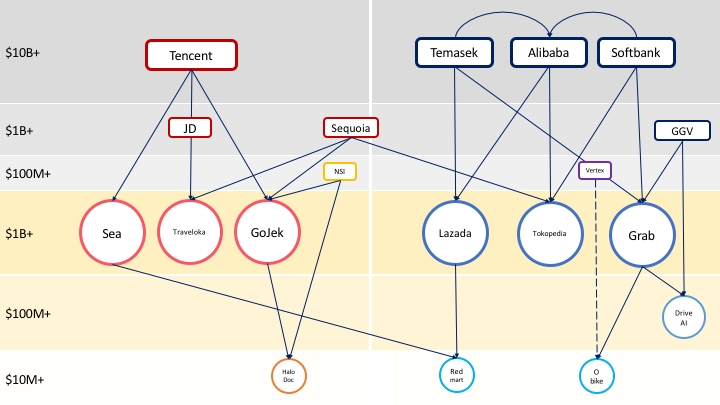

Here is one way to quickly map out your landscape. Just create a graph with all the big players in your sector. I have picked eCommerce/Transport here as they are quite inter-related in the Southeast Asian market.

It’s easy to recognize patterns from this map. You can clearly see the two Camps evolving, driven mostly by the Chinese gorillas (Alibaba and Tencent) who are both building their arsenals. It’s also apparent which Camp has more firepower and hence what that means for the eCommerce and Transport landscape going forward. If I were a startup starting to think of partnering with a gorilla, I would strongly weigh which Camp suits my strengths and weaknesses better, thus increasing the likelihood of survival and growth.

Here are some examples of predictions you can make based on simple pattern recognition:

- If Halodoc scales up it’s likely to receive significant funding from Tencent

- Tencent needs to find a player for eCommerce in Indonesia to back, and fast

- Alibaba might take a strong interest in Grab directly and soon

- GoJek will invest into driverless technologies and bike sharing soon

You can make many more such predictions. Some might come true and some might not, but you are likely to be closer to the truth this way. I urge you to do an exercise of mapping out the complete landscape for your own industry and figure out how these internal connections are poised for or against you.

Disclosure: We hold small ownership in Grab

Edit: Made some edits in the chart based on feedback, keep them coming

On a side note, I went on a writing sabbatical for a month. It was partly driven by a lot of work crashing down at the same time and partly by exhaustion of topics to write about. It was a refreshing break, I got some creative juices flowing, came up with a long list of topics, and hopefully I’ll be back with some more interesting pieces now.