ESOP deconstructed

10 things you need to be mindful of as you construct your ESOP scheme

ESOPs deconstructed

10 things you need to be mindful of as you construct your ESOP scheme

Founder 1:

“We can’t pay you much salary, but how about $100k worth* of ESOPs?

Fine print: *The exercise price is equivalent to $100M company valuation, which we expect to be valued at in our next round of fundraising”

Founder 2:

“So we just received an acquisition offer, but it’s essentially a fire-sale. You know those ESOPs we offered to you at the time of joining? Well the thing is we never really got around to setting up an ESOP structure. So maybe we can just forget about it and all of us move on?”

Founder 3:

“It’s been 5 years of your service to our firm, thank you for your amazing contributions! Well, as we have not yet exited, and now that your options are approaching maturity, you’ll have to start exercising them.

1. Please pay $50k to the Company for exercising these options worth $1M

2. Do remember to pay the $200k tax bill you’ll have to pay on the unrealised capital gains of $1M

But don’t worry, we’ll help you find liquidity within next couple of years and eventually you’ll be a millionaire!”

Employee 1, 2, 3:

Fu$#! 🙈

All of the above instances are common occurrences in the startup world, where employees end up getting screwed on their ESOPs. Like it or not, ESOPs can be the most valuable or the most frustrating part of an employee’s journey within a startup.

Off late, I have noticed that most early stage startups, even after announcing and committing ESOPs to employees, don’t end up formalising a proper ESOP policy. Part of this is because of lack of admin bandwidth during the early stages, and part of this is due to the founders’ lack of knowledge. So I decided to write a post, hopefully inspiring founders to structure their ESOPs early and fairly, while avoiding some common pitfalls.

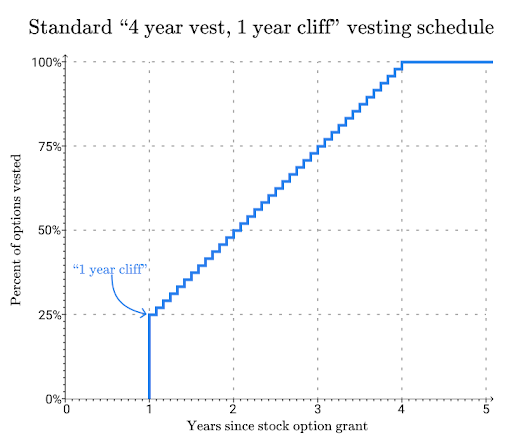

1. Vesting

Starting with the basics, it’s important to get the vesting schedule and structure right. This part defines at what pace are employee’s options going to vest, or in other words, at what timelines can each employee exercise her options.

Market Standard: 4 year vesting, with 1 year cliff, and monthly vesting schedule thereafter. What this means is that the employee will not earn any Options till she completes 12 months at the startup. Immediately after 12 months, 1/4th of the awarded options will vest, and thereafter 1/48th of the options will vest every month for 3 more years.

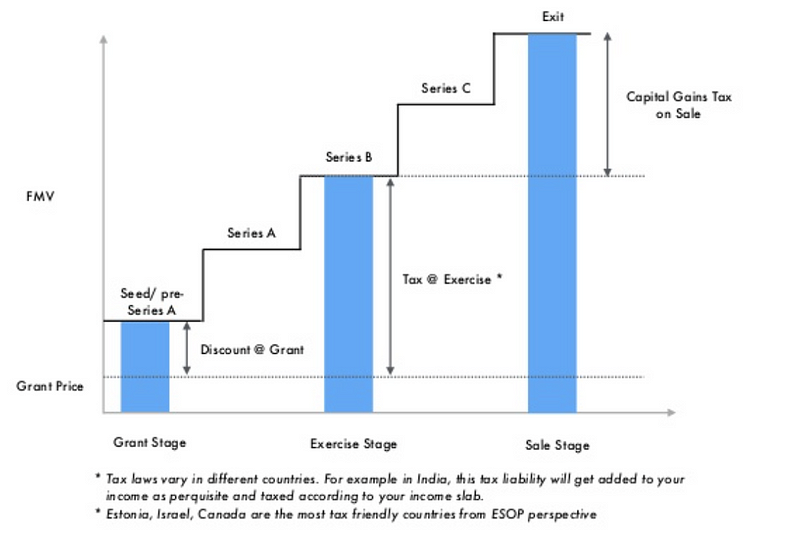

2. Exercise Price

“Stock options are like free money, right?”

Turns out, not really.

Something that is quite basic, yet confusing for many folks: a stock option is not a Share. You have been granted an “option” to purchase shares of the company in the future at a pre-agreed price — the strike or exercise price. The employee has to pay the company this price to exercise these options and receive Shares in return. If the exercise price is much lower than the price at which the shares can be sold —then the option is almost free money.

Example, let’s assume Joe gets stock options at the company’s Seed round valuation of $10M, but sells the shares when the company gets acquired for $100M valuation. In this case,

Joe’s gain = Share Price at $100M valuation — Share Price at $10M valuation

What is confounding for people is that most taxation authorities treat this gain as income, even though it is unrealised. Hence, receiving and exercising these options means you are liable to be taxed.

In Singapore, these gains are taxed at the time of exercising the options. So if an employee waits till a liquidity event occurs before exercising options, they can sell the shares in that liquidity event and (ideally) get some upside after paying their exercise price and tax bill. But if you’re a tax resident of any other jurisdiction, your treatment might be different.

Market Standard: What is the typical Exercise Price? Ideally, and most commonly, it is the fair market value of the Shares in the market at the time of Option grant, usually dictated by the last or ongoing financing round. But some companies use a fixed nominal amount, example a few cents, as the Exercise price.

Important Note: To protect the employees’ interests, ensure that the company can re-price any unexercised Options, whether or not they have been vested, in order to reduce the Exercise Price in case the fair market value of the shares decreases after the Grant

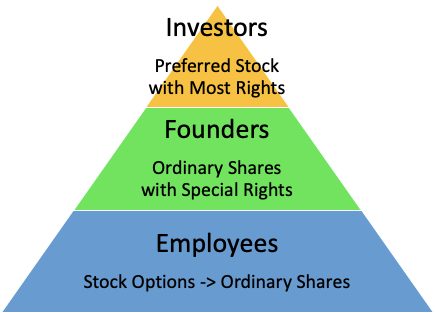

3. Rights of Shares

Assuming an employee exercises their options, they become shareholders in the Company. Does this mean they enjoy all the rights of shareholders, at par with the founders and investors? Typically not.

Market Standard: Stock options typically convert into Ordinary shares that do not enjoy rights such as ROFR, pre-emptive, anti-dilution etc. Further the shares are subject to drag-along rights from Investors (if mentioned in the Shareholders agreement), forcing the employees to sell their shares in case of a dragged liquidity event initiated by the investors.

4. Liquidity Accelerated Vesting — double trigger or single trigger?

This is where we start to go into gibberish territory. An accelerated vesting clause dictates what happens to the ESOPs in case there is a liquidity event (a.k.a. exit) of the Company.

A “Single-trigger acceleration” means that, on an M&A exit or a listing, all unvested options of employees immediately vest, and they can exercise all of their options, receiving shares in the company and thus partaking in the exit. This is obviously employee friendly, and sometimes seen in the market.

Market Standard: But the “Double-trigger acceleration” method is becoming increasingly common in the market as M&As mature in the region. In this method, there needs to be a second trigger for vesting acceleration — the employee being made redundant as part of the exit process. When acquirers buy a company, they typically prefer to retain the existing team, and not let them vest all of their unvested shares. In this method, the employees end up continuing with their usual vesting schedule, under the new company, usually with a stock swap to the new company’s shares.

Now you may think this second scenario is unfair to the employees, but sometimes the exit is contingent upon the management being able to retain the workforce, and without this important clause, the exit might not even go through. To mitigate these situations, I am noticing ESOP schemes in the region conveniently deferring the vesting acceleration decision to the time of exit, making it an eventual decision of the Board to adopt single or double trigger acceleration. Nothing wrong here in my opinion, as long as the board is functioning well, and considering the interests of all stakeholders at the time of exit.

5. Buyback

While it is easier to handle scenarios of clean liquidity events, a trickier situation emerges when an employee is leaving with unvested options.

In the case that the employee is a “Good leaver”, unvested options lapse, but the vested options end up needing to be exercised, either immediately or within a given duration. This definitely puts pressure on the employee to pay the exercise price or forego the options, similar to the case in (2) above.

But even more interesting is the scenario of a “Bad leaver”. In such a case, the company usually retains the power to cancel any outstanding vested and unvested options. Further, the company also tends to have a right to buyback exercised options at strike price paid at the time of exercising the said options.

Now this is obviously taking everything back what the employee every owned or had a potential to own in the Company. The natural question is, what defines such a drastic “Bad leaver”?

Usually this is attributed to:

(i) breach of a employment agreement or corporate policy,

(ii) gross misconduct, fraud or gross negligence,

(iii) misappropriation of Company proprietary information,

(iv) indictment, conviction or plea to a felony

6. Transfer of Shares

As you can see from (3) and (4), options tend to play the role of golden handcuffs. Naturally you may ask next, can the employee transfer their exercised option shares?

Market Standard: Well the answer is usually No. As these shares are Ordinary shares, they usually sit way below the rights of investor, and even founder shares. Companies tend to retain the control on transfer of these shares. On rare occasions, the employees can transfer the shares to:

(a) the Company — if the Company has fundraised recently or has crossed some major milestones and has the cash to afford a buyback,

Example — see Zerodha’s recent buyback of ~$9M worth of ESOPs

(b) an existing Investor — if it is difficult to purchase Primary shares in the company

Example — see Razorpay’s announced buyback of $10M worth of ESOPs

(c) an incoming Investor — if the current round is quite full, and the incoming investors want more ownership than they are getting in Primary shares

Example — see Unacademy’s announced buyback of 30% of ESOPs

All such transfers are normally controlled via the Board’s permission.

7. Taxation and other Liabilities

Assuming that the employee gets to vest or exercise their stock options, this usually generates taxation and other liabilities. (2) above is such an example of a tax liability.

Market Standard: Typically, companies add the following simplistic clause, shirking responsibility in the case of any such situations — “All taxation, stamp duty, levies, penalties are employee’s liability”

It’s arguable whether such a blanket statement is healthy in an ESOP scheme, but given the complicated laws around ESOPs in emerging markets, it is simply a risk the companies are unwilling to take.

8. Option Expiry

All options, including ESOPs, come with an expiry date.

Market Standard: In the case of ESOPs, this timeline is 10 years or lower, meaning that the employee needs to exercise the vested options 10 years from when the options were granted.

But what happens if the company does not exit within 10 years, yet is a large company with significant worth of shares? In such a case employees tend to have no other choice than to exercise their options, convert them into shares by paying the exercise price, and waiting for a liquidity event to occur. In fact this is a situation that has tied up many employees to huge unicorn companies that haven’t managed to find liquidity yet or announced buyback programs.

9. ESOP Trust

One interesting challenge occurs in executing ESOPs in younger markets such as Singapore. Singaporean private companies cannot have more than 50 shareholders, and as ESOPs get exercised, the employees end up becoming shareholders.

Market Standard: As a result, a trust usually gets created with the Board’s approval for allowing employees to be shareholders but at an arms-length distance. This trust, and the expenses for the same, are managed by the Company.

10. Authorised Leaves or Sabbaticals

What happens to the vesting timeline in case of longer-term leaves, say maternity/paternity leaves? What about sabbaticals?

Market Standard: In such a case I have seen Companies taking a humanitarian stance towards vesting. Unvested Options continue to vest as per the vesting schedule in case of authorised long leaves/sabbaticals. But in the case of voluntary time-offs for longer durations, the Company tends to have the right to alter the vesting schedule accordingly.

So there you have it: 10 common pitfalls to be avoided when structuring the ESOP.

Important Note: Do not treat any of the above statements as legal advice. If you’re all excited to set your own ESOP scheme up, do consult a lawyer who can help do this for you for a nominal price. Eventually, you will need your Corporate Secretary to adopt the ESOP scheme for you.

If you want to skip the legal help, and want to stick to standardised agreements, you can run with some online policy templates, example Kindrick Partners’ great guide and template on ESOP scheme in Singapore. One thing to note is that unlike mentioned above in (4), Kindrick’s template goes with a Single-trigger accelerated vesting, which they claim is more common in Singapore, but I have personally seen less of.

Another law firm, Cooley Go, has a great article on ESOPs as well, but they don’t provide a template scheme as of now.

If you do come across other templates, or have follow-up questions, feel free to DM me.