How a VC funnel works

Using real data from GREE Ventures South Asia

Using real data from GREE Ventures South Asia

Every business has a funnel, so does Venture Capital. As many investors will point out, our real customers are entrepreneurs. It’s obvious then that VCs end up creating a funnel for their deal flow, just like you’ll do in any other business.

GREE Ventures is not a Spray-and-Pray fund, we are on exactly the opposite end of the scale. There are only a handful of funds globally (Lightbox in India, Cervin ventures, Costanoa, and Aligned in US, and us in Asia) who take a curated 10-deal strategy for an early stage fund, due to the inherent risk in this mode of investment. However, we do feel this is the only way to generate good returns for our investors and be respectful to our founders for having placed their trust in us, by spending concentrated capital and effort on each investment we make. The implication of taking a curated strategy means it takes us longer to qualify investments internally as we cannot rush into deals. To counter this, I spend a fair bit of time analysing our deal flow as it moves through our funnel (or pipeline as most investors will call it) to ensure that we are being efficient and overall on top of our pipeline.

“What’s measured improves” ― Peter F. Drucker

And hence we measure our pipeline a lot.

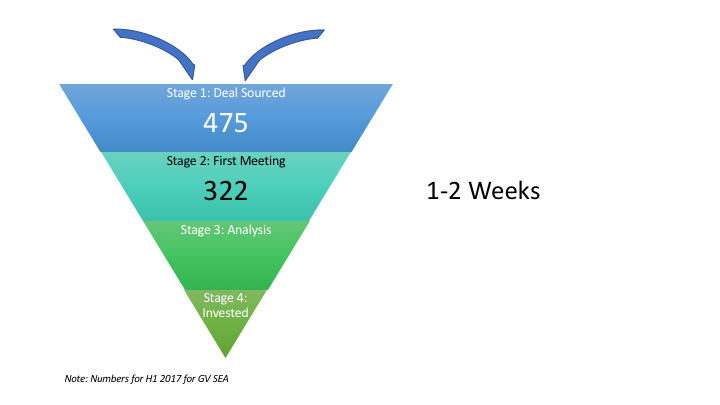

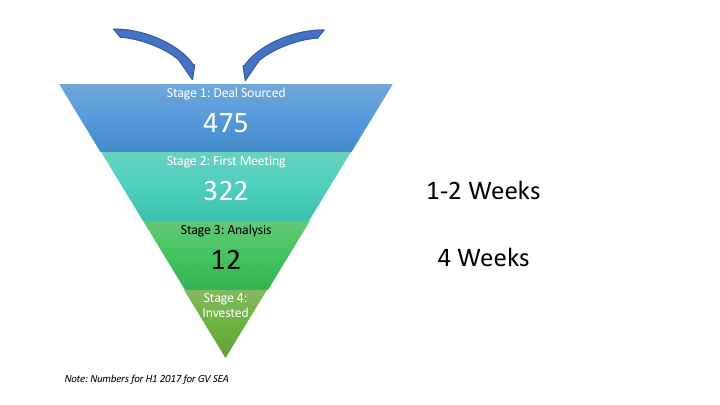

Stage 1: Deal Sourced

It all starts from the top of the funnel. Hunter Walk has a great post on how “you lose 100% of the deals you don’t see” and I totally agree. Given that in Asia we tend to see a lot of startups that are aiming for similar business models in the same industry it’s even more important for a VC to be seeing all the possible deals in a sub sector so that she can pick the best team out of the few companies in that space. This is why you see VCs in Asia be very active and approachable, especially in tech conferences and events.

TL;DR, VCs need to keep the top of the funnel very broad, so that they can get as many deals into the pipeline as possible.

This year at GREE Ventures SEA we have already seen 475 deals enter our pipeline. This is through a combination of various sources, both inbound and outbound. While inbound (more likely) includes LinkedIn connects, Email Introductions, Website form, outbound are those where we actively reached out to a company (less likely) either directly or through a reference. The number has been a bit lower than usual due to the state of the ecosystem and also I was manning the fort singlehandedly for a few months. This has since changed and the second half of the year is likely going to be much busier for us in terms of deal flow.

Stage 2: First Meeting

Once a deal enters our funnel, we spend anywhere between 1–2 weeks on this stage of having the first meeting with the founders and then an internal discussion. The work here involves the managers talking about the company within the team and doing a quick gut check to see whether this particular deal can be a good fit for the fund. The better a team’s processes in managing and discussing deals internally, the faster this stage can be.

We (mostly I) met 322 companies in the first half of this year. That’s roughly 100 working days (taking out holidays, business travel, weekends) meaning an average of 3 companies a day. For context, I have written previously about “Days of our Lives”.

As most founders will tell you, an early no is much appreciated in the industry than keeping a company hanging, and eventually saying no. Since the time I took over the pipeline this year, I have really tried to focus on this. For me, the easiest way to track this internally has been in what I call ESNO or “Efficiency of Saying No”. As you can see from the chart, our efficiency has increased significantly over time and my internal aim is to keep this number below 10 days. The last couple of months have been much lower mostly because the deal flow was heavily influenced by conference leads, companies that are usually easier for us to segregate and find the right ones for us.

Stage 3: Internal Analysis

While building a strong network helps you get the top of the funnel right, the real art in VC is in immediately narrowing that funnel when moving into the next stage. This is because VCs have VERY limited resources. While startups go from 5 (Seed) to 30 (Series A) to 100 (Series B) employees in a time space of 3–5 years, a VC firm would not even swell 2x in size in 4-5 years (when we raise our next fund). What this means is that we need to be very selective in the companies we spend time with and be very good at early weeding process.

This stage is the one where the deal would spend the majority of time sitting in our pipeline. We spend any where between 4–6 weeks working through the material shared by the company, the multiple back and forth conversations we have with the entrepreneurs, preparing material to discuss with the partnership (which acts as an IC for us at GV SEA), and conducting internal and external DD on the company.

At GREE SEA we usually cut out almost 90% of the companies in Stage 2 so that every week we are only processing 2–3 deals internally, usually one per manager. This helps us focus on selected companies and industries, and overall make quicker and (hopefully) better decisions. The deal flow as you can see for H1 2017 has been not as good of a quality, where we have only selected 4% of the companies to follow up with. The whole market currently is experiencing the same, and these numbers just put some facts behind the gut feeling. A separate post to follow up on some reasons behind this.

Stage 4: IC, Negotiation, and Investment

This stage is where our real decisions are made. When the manager leading the deal presents to the IC, its a one-shot make or break for the company. There is a clear outcome at the end of the meeting and if the deal goes through our IC the term sheet is issued to the founders containing the valuation and terms that the fund is comfortable with for this deal. A quick negotiation round is held with the founders in case there is any pushback, and if everyone agrees to the term sheet issued, we finish the documentation and close the deal.

While this stage is probably the fastest in the whole cycle (usually a span of 1 week from IC date to signing depending on docs required), it’s also the most critical as the partnership sees the deal properly for the one and only time. There are a lot of questions asked, but for the benefit of the founders the manager is already convinced of doing the deal in this stage and is usually on the same side as the company.

At GREE, we do only 1 deal per quarter. This means we see around 150 companies before pulling the trigger or only a 0.5% conversion from first stage.

What this means for you?

If you are a founder raising your first round, this post above presents some implications for you. Regardless of which firm you are approaching, whether us or another, there will be an internal process within the fund and its important to be mindful of the following:

- Figure out at all times where you are in the process. Not every fund is well structured and numbers driven. I know of many popular VCs who don’t have a formal pipeline process internally and hence you need to figure out their funnel for yourself to see where you stand. This helps you plan your fundraising better and not spend undue time waiting for a VC to get back.

- Not every deal is fit for every fund, and hence you need to see many many investors before the funnel’s conversion and probability laws start kicking in. Just like we have our funnel, you should create yours and try to move VCs from the top to the bottom.

- Know that you are competing for mindshare. It’s not enough to be a good company in the funnel. You need to be the best in the investors’ funnel at that point of time to be able to proceed to the next stage.

- It’s never over till it’s over. The final milestone is the most important and as you can see from our data, the conversion rate of the last stage is quite low. Just because a VC has shown a lot of interest and has had multiple conversations doesn’t mean they’ll do the deal. Hedge your bets and be prepared for a No.

- You can always re-enter the funnel again, and usually just try to move to the next stage. In case the first time you reached out you could not even get a meeting, try another shot after a few months through a reference. In case you get rejected after the first meeting, ask for feedback, and next time approach the VC with the concerns solved so that you can proceed to the next stage.

Hope this is helpful for founders to see how a VC fund works internally. In case an investor is reading this and disagrees with the process or has another process internally, would love to know more, please drop a line in the comments.

P.S. Signing off from Bali, eating a Haloumi bowl, looking out at rice paddies as you probably read this from your office. Apologies, couldn’t resist.