Indonesia is suffering from early stage fatigue

And the reason we launched SKALA

And the reason we launched SKALA

Cat’s been out of the bag for the last few weeks, and most likely I have contributed to your spam folder already. Please forgive me for doing that, simply restore the email to inbox and read it 🙏

We recently partnered with Innovation Factory/Block71 (a Salim Group initiative) to launch SKALA an accelerator in Indonesia focused on launching and scaling startups that are solving grassroots-level problems in the market. I thought I’d write a post to explain some of the reasoning behind this action.

Now I know what you are thinking:

An Accelerator?! Not again….

(rolls eyes, yawns, picks up phone, quickly scrolls through Insta, gets bored seeing cat photos and looks up again)

Yes. An Accelerator. But (hopefully) not just another Accelerator. An Accelerator that makes a difference. I’ll dive into how we plan to do that, but let me start with the problem.

The Problem

Number of Companies registering this year

Number of Seed rounds happening in the market

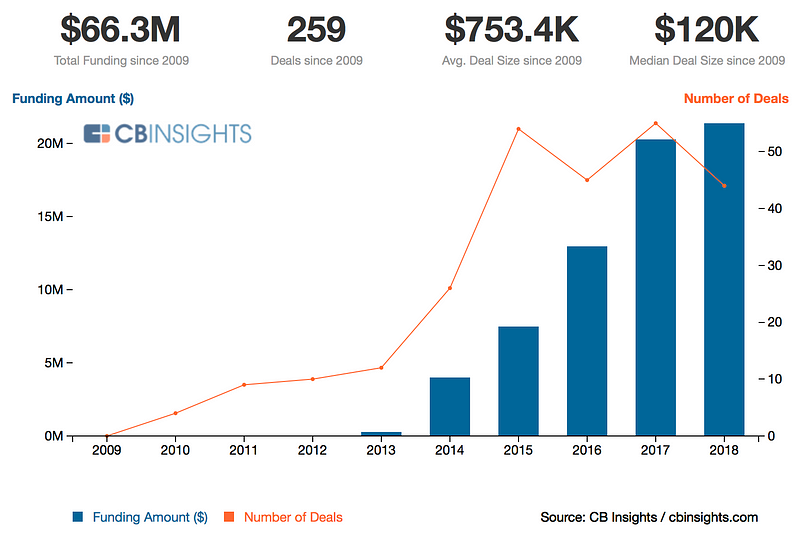

I am not sure why no one in the industry is talking about this, but Seed deals in Indonesia have flattened for the last 4 years. This means less number of options for later stage investors, and increased capital allocation for each startup. This is the reason why we have been seeing round sizes go significantly higher in last few years. To be sure there is a lot of data missing from CBInsights, but I highly doubt that even with unannounced rounds, the data will show any sort of spike in Seed stage investments. As a comparison, India saw 10x the amount invested last year in Seed stage alone.

To breed real innovation in the country Seed investments need to be roughly tenfold of what they are at this point. While it’s unlikely this will happen with the same amount of cheque sizes, we as an industry can at least try to incubate startups with a small amount of capital to solve local problems.

Number of Angel investors in Indonesia

While there are quite a few recent crop of angel investors in the market, there is a huge gap between Indonesia and some of the other mature markets in Asia. As an example, Angin.id, likely Indonesia’s largest angel network quotes 72 investors on its website:

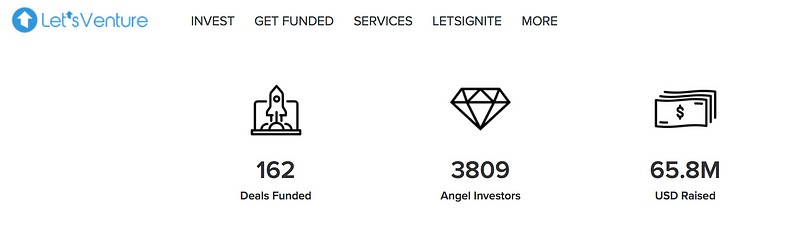

Meanwhile, LetsVenture, India’s largest angel network platform has 3809 angel investors on its platform. Indian Angel Network has 500+ investors listed on theirs.

Angel deal-types being seen in the market

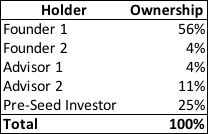

Here is an actual cap-table that we saw in a transaction recently for a Seed stage company in Jakarta:

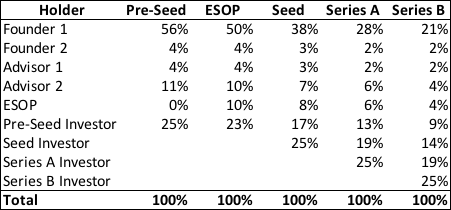

The deal was $70k for 25% of the company, or a $280k pre-money valuation for the first round. If a pre-Seed investor owns 25% of the company, which is one of the better chances you as a founder have in the market, then the founders get diluted to less than 30% within Series B. Here is an example of how that works:

These sort of predatory deals are rampant in the market, and it puts the company on a bad footing for future fundraising from their first day itself.

Implications

As the early stage risk capital becomes more difficult to find, there are major implications of all of this:

- Fewer deals happen in the early stage and capital accumulates into these few deals

- Seed funds move on to Series A to be able to deploy larger pools of capital, Series A funds move on to Series B, and Series B funds either expand horizons or shut down

- Less companies breed less innovation, and the market ends up seeing same old me-too companies with models proven elsewhere, with barely any intent to solve a real problem on the ground

The Positives

But, don’t get disheartened. Not all is sad and gloomy.

- For the first time, Indonesia has come on to the global map, thanks to the multiple unicorns born in the market in the last 1–2 years.

- Late stage capital from all parts of the world: US, China, and India, is starting to chase the market, and this capital is hungry to tap on to the next big white space in the startup world.

- And lastly, there is a new breed of talent which is leaving the unicorns and other late stage companies, to start companies of their own. And this is what matters the most.

Solution

But how do we solve this early stage capital/company drought problem in Indonesia? Well, luckily, there is an easy way:

More Smart Money doing more Seed rounds faster

As I said in my previous post, we moved a stage earlier to solve this early stage challenge in the market. But we are also limited by the amount of capital and bandwidth that we have. Unfortunately, VCs do not scale as quickly as problems and gaps emerge in the startup ecosystem. And this is why we decided to launch a platform that can kill two birds with one stone:

- Create a playbook of all that we have learnt in the last few years of our investment success and failure in the country and impart this playbook to early stage companies who need the most help

- Be able to provide a company that pre-Seed/angel capital it needs to build the MVP and test it in the market.

And from this was born: SKALA

SKALA — What’s different?

- Execution > Fundraising 🚀

At SKALA we plan to focus on getting the company to execute faster than ever, with an obsessive eye on key metrics. It’s our fundamental belief that if you build a company in a large market with good fundamentals, capital will run after you rather than the other way around. - Operating Partners 👨🔧👩🔧

Each startup at SKALA will have a designated operating partner, who comes with experience of building companies and having significant exposure to the respective market, in a manner quite similar to how things are run at an institutional fund. - Grassroots Problems 👨🌾👩🌾

While the program is agnostic towards sectors, the objective of every one on the team is to enable companies to solve some fundamental problems existing in the country. This could be in sectors such as agriculture, logistics, supply chain, healthcare, financial services, and so on. - Global mindset and Local distribution 🛵

While GREE Ventures along with the many mentors aims to provide a regional knowledge-base of successful business models and execution, Salim Group brings in massive distribution channels within the country and a plethora of problems looking for solutions. The startups will get access to mentors, both global and local, who will be paired specifically for the teams. - Upfront Capital 💸

The program offers upfront $30,000 for 5% common stock equity. Yes you read that right. There are no pre-conditions to this, the moment a startups gets selected for the program, it gets the cash in the bank with no strings attached. - Fair terms ⚖️

As some of you might know, I am a stickler for founder-friendly terms. If you have read my earlier post on “SAFE” notes, then you’d realise that SKALA’s equity funding structure is crafted in a way such that it sets an example for the whole region to follow. We are likely the only program in Indonedia that discloses the exact term sheet a startup would be signing. And we are proud of this. I plan to write a more detailed post soon explaining the terms in the deal part-by-part, so do keep on a lookout for that.

And this is just the start of it. The list can go on and on, but I’d simply leave you here with some logistics details for SKALA:

Application Deadline: 14th September, 2018

Link for Application: http://joinskala.com

We hope to achieve a lot more in the country through SKALA and other initiatives that we’ll bring to the table in the future. Special thanks to Block71/Innovation Factory for embarking on this challenging journey together.