Mostly Harmless

Knowing what your tummy can handle.

Knowing what your tummy can handle.

This week we talk about measuring and managing risk appetites and why it’s important for both investors and entrepreneurs to be aligned on their risk profile. And where best to start from than with a line from one of the greatest Comic-Sci-fi-Borderline-Neurotic book ever written?

Protect me from knowing what I don’t need to know. Protect me from even knowing that there are things to know that I don’t know. Protect me from knowing that I decided not to know about the things that I decided not to know about. Amen. — Douglas Adams, Mostly Harmless

On to serious stuff. Mattermark was very kind to share a great post by Hunter Walk, partner at Homebrew, this week. The post revolves around a simple question — “What’s a risk you’re more comfortable with than the average VC?” Here is an excerpt from the post that explains the reasoning behind the question:

Potentially the best founder <> fund matches come when both parties are clear about what needs to still be proven out -and- the venture investor has some ability to assist the founder in de-risking. If the investor is taking on a risk that fundamentally makes them uncomfortable, they’re going to pressure the founder to mitigate that risk as soon as possible, which *might* not be the right priority for the specific company.

I feel the statements above make total sense. In a parallel post to this, Christian Claussen from Ventech gives similar advice in his blog on why you should raise money from an investor who understands the risks inherent in your company and can help you de-risk some of them.

If your investor is not as professional and/or hasn’t really spent enough time learning about your business to figure out the inherent risks, he or she might be surprised a few weeks into the investment with the trajectory of the company. Worse, the investor might not know how to help you remove some of these risks. Even worse, he or she might push you into making decisions you don’t want to take in order to de-risk insignificant risks.

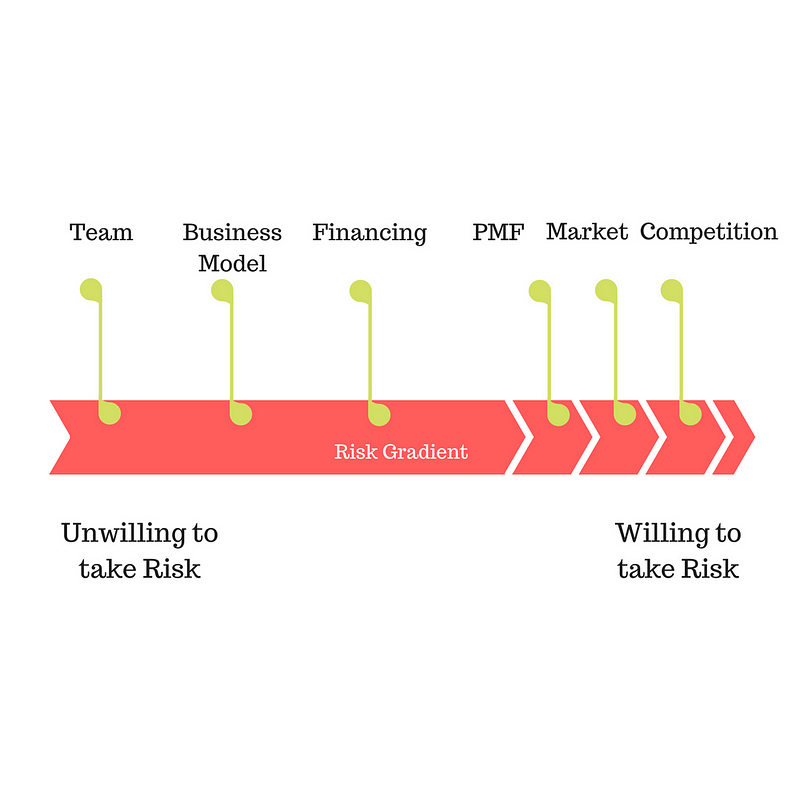

Before this post, I hadn’t really thought through risk the way Hunter Walk represents it. Now, I do feel it makes sense for every investor to figure out what risks they are comfortable taking and what not. And surely this can change from company to company, but overall the comfort factor with certain types of risks will remain similar for the investor across companies. I decided to do the exercise this week and here is a preliminary risk analysis I have done for myself. While this might be different from my fund’s risk profile, and is only an indication of what risks I personally like to take on, looking through our portfolio its quite likely that our fund’s risk appetite is similar also, and hence I assume so for the rest of this post.

A few definitions of each kind of risk to begin with.

- Team Risk: “this might not be the best team going after this particular problem”

- Business Model Risk: “let’s reach scale first, we’ll figure out how to make money later”

- Financing Risk: “Founder(s) might not find it easy to raise further rounds”

- Product Market Fit Risk: “Market might not accept the product because of low/no value”

- Market Risk: “Size of the market might turn out to be smaller than our assumptions”

- Competition Risk: “Strong competitors exist or might crop up in future”

Going on to our fund’s risk profile, let me consider it deal by deal for the last 6 deals that we did:

- Startup 1: Has significant competition risk. There are at least 3 decently funded businesses in the space, all of them similar size. The company, in my opinion, is executing the best out of all 3 and is likely to become a leader soon. Overall we like the team, and hence are willing to support the company.

- Startup 2: Has a lot of risks. Competition risk exists from well-funded rivals in US. Product-market fit has not really been properly tested yet. However, after doing a few customer calls, I decided that the product-market fit risk is not huge because a handful of customers are definitely using the product very actively. Also, I felt the US competition we can ignore for the short-term as the company is Asian and can potentially double down on domestic market if they face significant competition in US.

- Startup 3: Clear product market fit risk. Whenever this company comes up when I am chatting with fellow investors, they put a very inquisitive look and ask me politely, “so what was the thesis there”? Most of the times, I know they are thinking “this is never going to work”. I am happy to invest in business models that only I see less product-market-fit risk in. Successful companies are built by swimming against the tide, not along with it.

- Startup 4: Signficant competition risk. There is a 300 pound gorilla sitting in the market, and every investor asks me the same question when I discuss this company with them, “Umm, what about Mr. Gorilla”? I neverthless wholeheartedly believe in the company, mostly because of the team, the need in the market, and the fact that Mr. Gorilla seems to be facing an identity crisis lately.

- Startup 5: Signficant competition risk again. There are probably 10 global companies solving this problem one way or the other. I believe this company has the best product out in the market for solving the problem. So far the company has done well.

- Startup 6: Huge product market fit risk. This startup was undergoing a pivot when we invested. It was a big leap of faith to invest in it, but has turned out to be one of the best outcomes we’ll see in our first fund. A few customer interviews and the quality of the founding team gave us the conviction of backing the company.

By now it should be quite clear what’s the biggest risk we are willing to take that other funds might not. Competition. I am not saying it makes sense to go head-on against a direct competitor who might be 100x your size. However, if you do think there is such a competitor in your space, my recommendation is to figure out what is it that will make you succeed over the competitor. Is there any way you can capture signficant market share from competition? Better, can you expand the pie instead of sharing it? Even better, can you do both? If the answers to these questions are a resounding “Yes!”, then I am fine with having existing/future competition in the sector.

A few other simple risks our fund has taken in the past that others might have cringed at:

- Founding team is a couple

- First time entrepreneurs with no big brands on their CV

- Company pivoting to a new business model

- Market is yet to hit the inflection point and we are “too early”

I’ll try to update this risk graph in case I feel the need to do so in the future, but for now this is what my risk profile looks like. If you are a founder going through an investment round right now, I urge you to ask Hunter Walk’s question of your prospective VC, and make sure you are comfortable with the answer you receive.