Predictions 2018: The Year That Will Be

Asia, as seen through the lens of a VC

Asia, as seen through the lens of a VC

Happy New Year!

It’s been some time since I wrote here. It was partly to do with a last minute deal we closed in 2017 (more on that next time), a 2 week vacation in Vietnam (most peaceful and beautiful people I met), a few posts on TechInAsia, and a lot of internal thinking.

Is it just me or the last year really went by in a flash? I transitioned into a new role with greater responsibilities, hired a great manager to help me out, started this blog and wrote 40+ blog posts, made 4 new investments (3 India, 1 Singapore), helped up-rounds of 2 portfolio companies, and exited 1 company. All in all, very eventful, without a single dull moment in life.

End of the year is a great time to step away and look back at where the fund is going, how the portfolio is performing, and what the fund will explore next year. It’s also the only time I will make market predictions for the next year. Many folks in our industry do this, see Fred Wilson and Semil Shah.

Over the year-end vacation, I finished reading The Black Swan. If you are an entrepreneur or an investor, and haven’t read it, please put it in your to-read list this year. I concluded from the book that we should stop making predictions, but here I go breaking that same rule: just once a year.

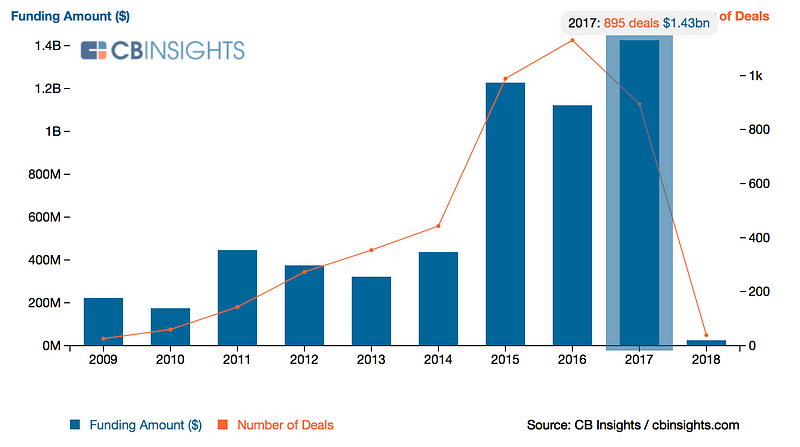

But first, let’s quickly break down how the year 2017 went for startups and venture capital in Asia. I’ll focus on only the markets I care about: Southeast Asia and India. Starting with the overall funding deployed in the market, you can see a huge spike in 2017. There is only one reason for this, you guessed it: Softbank. For the first time the emerging Asian markets saw billion+ dollar funding rounds; 4 out of 6 them were led by Softbank (Flipkart, PayTM, Ola, Grab).

While the overall environment looks good, the deal sizes and numbers are heavily skewed because of the late stage funding environment. If you restrict to Seed and Series A, this is what the market looks like:

The amount of funding in early stage is stagnant since the gold rush of 2015. It is likely to remain like this till a new rush of capital comes in.

As for individual markets, here is my summary for 2017.

India-2017

2017 was the year of reckoning in India with the downturn in funding as well as crashes of companies like Snapdeal and Freecharge. It was the year finally that investors stopped supporting the second runner-ups and started focusing on the category winners.

Singapore-2017

Boom of fintech and the government’s re-entry into deep-tech verticals and fintech. Singapore government is trying to pave the way for the country becoming the flag bearer for tech in the region. In 2010–2013 timeframe this meant supporting startups. In 2017 this meant supporting AI and fintech startups.

Indonesia-2017

2017 was the Year of the unicorns with Grab, Toko, GoJek, and Traveloka all receiving massive funding rounds to fight it out amongst themselves. The market is shaping out to be an interesting one where all of these companies are trying to become horizontal players rather than stick to their own verticals.

2018: The year that will be. And here is what I predict for the region for this year. I’m prepared that most of what I predict will not happen, but we’ll still do a fact-check next January.

India-2018

“From the ashes a fire shall be woken,

A light from the shadows shall spring;

Renewed shall be blade that was broken,

The crownless again shall be king.” — Tolkien

For the early stage, strong companies will be built from all the learnings of previous failures in 2016–2017, and 2018–19 is likely to be one of the strongest cohort of startups that the country will see.

As for the later stage, the power will consolidate further among 2–3 startups, likely to be Flipkart for eCommerce and PayTM for Payments. I don’t think this year will be the one where the winner between Amazon and Flipkart will get decided.

Singapore-2018

“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.” — Vitalik Buterin

Singapore is likely to become a hotbed for AI-focused companies as well as blockchain-economy. The startups will tap on to the small but skillful data scientist talent in the market. As for blockchain and crypto, while the other countries might denounce crypto, the government in Singapore will regulate and support at least the major currencies and will come up with a framework for a blockchain license.

Indonesia-2018

“Now this is the Law of the Jungle — as old and as true as the sky; and the Wolf that shall keep it may prosper, but the Wolf that shall break it must die.” — Rudyard Kipling

A lot more fighting will occur within the unicorns as they start encroaching on each other’s territories. It’s the only market I know with 3 active ride hailing companies, multiple ecommerce giants, and multiple players trying to build a payments vertical. 2018 is when clear winners will start emerging in each vertical and the losers will fall on the sides.

We’ll also likely see a lot of early-stage acquisitions by these same unicorns, hungry for talent and new ways to justify or increase their valuation. Some of these have already started to happen, especially in the payments vertical. The next set is likely to be in other fintech sectors and enablers.