SEA is facing a new problem: Fund Creep

And the gap emerging in the Seed stage

And the gap emerging in the Seed stage

I’m sure you’ve heard/read this story before:

It’s easy these days to raise a Seed round in SEA. There are so many investors doing Seed/Series A, but hardly any one in later stages. Series B/Series C is a big gap, but till then you are fine.

Let me tell you a new story:

Wrong. Wrong. Wrong.

If you are an early stage founder in SEA, then gone are the glory days of 2014-2015 where every one’s cat was raising a Seed round. There was capital influx and not much to put it in other than in (poor) deals. But it has all come crashing down since. I don’t need to show you data for this, go look up any database you’d like.

But where have all those early stage funds gone? Isn’t the market brimming with VCs? Isn’t TechInAsia Speed Dating full of them? The funds moved on to bigger and “better” things, leaving behind a wake of (good) founders who are scratching their heads every time they hear the word “traction”.

Data

So let me show you some data around this.

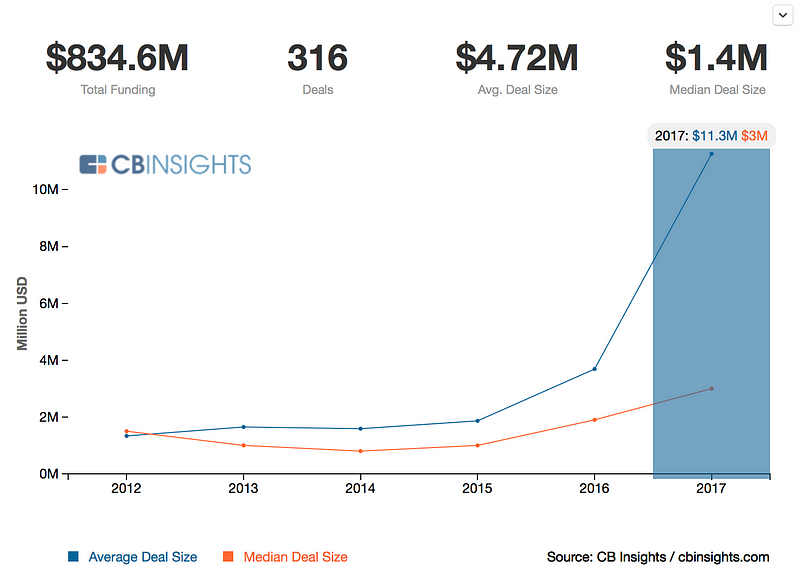

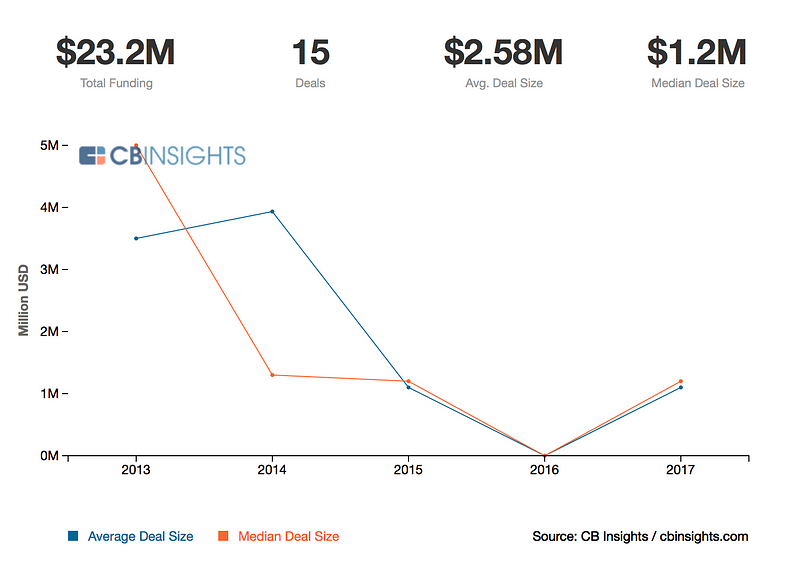

These are the average/median deal sizes over the years for the top 5 early stage funds (in order of their activity) in the region. I won’t name them, because it’s bad to name names, but you can do your own CBInsights/Crunchbase research and will get similar numbers. Notice anything weird? Right when the market starts tanking in 2016, the average and median deal sizes started significantly increasing. Wondering what the reason is for this?

I can wager a few.

- Mitigating Risk ☠️

Let’s start with the simplest. If you were a VC and your portfolio is starting to feel the affect of a downtrending market in early 2016, wouldn’t your obvious reaction be to stop taking more risk? A normal investor would stop investing or start taking a risk-averse approach. Well Series A companies are supposed to be post product-market-fit, so why not focus on them? - Portfolio Burn🔥

Also, if you’re the same VC as in (1) and nobody is stepping up to do the Series A round because the market has gone down south, you have no other choice than to raise another fund and back your better performing (or all) portfolio companies again and give them breathing room for another year or two. - Return on Time and Effort ⏳

Hey, did I tell you Seed stage investing is really hard and time consuming? To start with, there are so many deals. How is an investor supposed to meet all of them? And then there is hardly much to differentiate one team/competitor from another at this early a stage. Plus you have to put so much time in selecting and working with an early stage deal, all because you put in a few hundred thousand dollars. All this while very few investments really move the needle.

Contrast this with Series A. Most of the deal flow is known. Just go ahead and do a Crunchbase search of all the Seed rounds that happened in your market in the last 2 years, and that will constitute 80% of your deal flow. Companies now have metrics and you can start comparing them.

Haven’t reached $1M ARR yet? “Sorry, too early.” So you want $15M valuation when you haven’t monetised? “Stop day drinking.” And so on.

And sure the Series A investor needs to support the company substantially with more than just money, but now the economics of putting in a few million dollars and working closely with the companies starts to make sense.

4. Management Fees

The devil is in the money, always. Moving up from Seed to Series A or from Series A to Series B means you can justify to the LPs that this time around you want to raise a much bigger fund. 5x the size of the last one, or maybe more.

This means you now suddenly make 5x the management fee (hey, man’s gotta eat). So while the whole market is tanking and the portfolio is performing poorly, the VCs can raise a bigger fund, earn more management fee, and throw that annual sundown drinks.

But of course, it can all just be because “there is a gap in the later stage”.

This problem is going to get worse and if you are an early stage founder, it will be harder to raise Seed rounds this year. But don’t worry, there are a few funds cropping up to solve the issue.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” — Warren Buffet

- SeedPlus started a couple of years ago and focuses completely on the Seed stage. Come from the operating background.

- Cocoon Capital and KK Fund launched new Seed funds

- And yours truly, GREE Ventures, went the opposite of where every one went. While all our peers (similar fund sizes) decided to move upwards to larger Series A and B, we decided to move downwards, to Seed.

Don’t get me wrong. Series A/B investors play a huge role in an ecosystem, so they are needed for sure. I am just stating facts and problems in the Seed stage.

I am sure there are a few more funds apart from us who are actively looking at only Seed rounds in Southeast Asia and are in it for the long run. So reach out to any or all of the above Seed funds if and when you decide to raise a round. We’re all just a shout away.