The Many Faces of Winter

A quant-dive into Asia’s funding environment.

A quant-dive into Asia’s funding environment.

A lot has been said about the long standing winter that hit the startup ecosystem. Back in SEA, from Shailendra Singh’s shrug-off in Tech In Asia Singapore last year to Khailee’s don’t-give-fucks in the same conference, most investors proclaimed that their investment activity will remain the same. There are no doubts that the market has softened since then, but it’s good for founders and investors alike to take a rational standpoint.

Before we look at some of Asia’s numbers, let’s look at what happened in the Big Brother. Mark Suster makes a case in point in this article that US winter is already over. He has data to suggest that it’s because LP distributions have overshot Contributions in the last 4 years thus making the LPs a “believer” in the ecosystem. Further, whatever tightening happened inside the US funds, the CVCs and Global VCs (essentially China) stepped in to fill the gap.

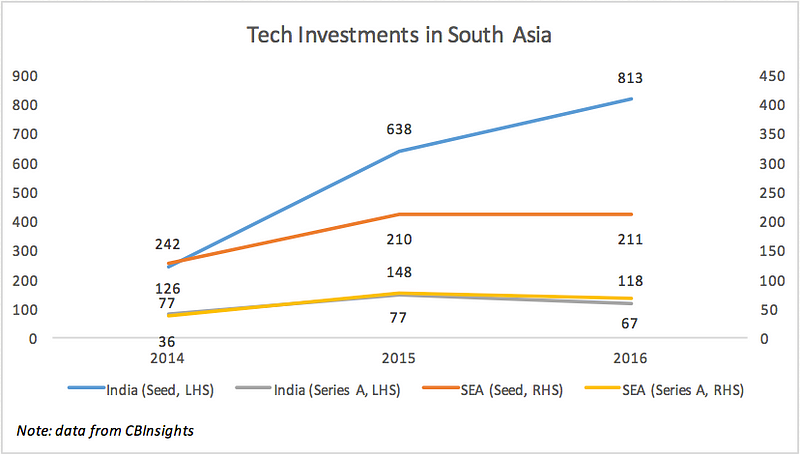

For Asia, I don’t recall reading lately much about investments in 2016, so I decided to dive into the data on my own. I restrict my analysis only to South Asia as this is the region I care the most about. Also, I put SEA on the right axis and normalized the scale to give a population-scaled view of the number of investments.

The chart tells you a lot about what’s happening.

- There is a clear Series A downturn in both SEA and India in 2016. After my conversations with funds in both regions, this is partly because of a Series B pushback and partly because of rationality setting in amongst the investors.

- Seed stage bulls are still raging in India. This was primarily driven by a strong angel community, more on this in a later post. While this is definitely healthy for the ecosystem and will mean we’ll continue to see good amount of deals coming from the country, I also feel this number is likely to drop or flatten in the short term. Lately Indian startups have been in the news for all the wrong reasons and this will definitely hit the morale of the angel investors. Already founders are telling me of angel purses tightening up in the country.

- Seed stage in SEA is lagging a lot, even on a population scaled basis. One thing to be noted is that even in the irrational period of 2015, SEA seed investors still maintained tight control over their investments. This I feel is bad for the ecosystem. Seed stage cheques are essentially written to test and experiment on product ideas, and I would rather have more than less of these.

While US had the luxury of enough CVCs and Chinese funds chipping in at the later stages to keep the market morale high, this did not happen in India and Southeast Asia in the Series A and beyond stages. The jury is still out on whether this is likely to change, and I am hearing talks of some late stage startups currently fundraising in China, but we’ll have to see whether something changes drastically in the next few months to give a renewed kick to the ecosystem.

So how does this impact us as GREE Ventures? My role as an investment manager is to recommend to the partners the right strategy based on what I am seeing on the ground, and this is how I view the potential next steps for a geographically spread and flexible stage fund like ours:

Stay Hungry Stay Bullish. Great companies are built both in the times of exuberance and downturns. There is no data to reveal that the short term funding cycles have any impact on a company that has proven product market fit and a scalable way to grow. Fred Wilson gave a great interview to Dan Primack in Upfront Summit 2016. While the whole video is worth watching (every second of it), the key takeaway for me was when Fred said:

“If you look at the history of Venture Capital, going back to the 70s, every year there are roughly 20 or 30 investments that if you made, you made a fortune. Every year! There is never a year when that’s not true, and there’s also never a year when that number is 200. It’s about 20–30–50 companies a year, and you gotta get one of them. That’s our job.”

Aim for the cracks. As a decent-sized fund, we have the flexibility of going in early at Seed stage into more companies or going in later at Series A stage into fewer companies. If we have the flexibility to do this, I don’t feel the fund philosophy should be struck down to being either/or in the markets that we play in. For SEA, according to the chart above, the gap seems to be in Seed stage. And having been Series A investors, we have felt this personally, with not enough good deals coming through our way. As a result, we have been going in earlier and the only two cheques we wrote in SEA last year are in Seed stage. For India, again referring to the chart, the current gap is clearly in Series A stage. But with not enough firepower as well as understanding of the market, we are co-investing with the Series A funds.

Two heads are better than one. I have mentioned this in a number of my previous posts, such as here and here. Our fund believes in playing an active role in the portfolio company. I’ll probably write a separate post one day on how we do this, but in tough times, this strategy is even more important. For example, I am currently urging a couple of portfolio companies, which I feel will find it difficult to fundraise in this environment, to steer the ship towards break-even. We are paying increased attention to the line items in the expense sheet of the monthly KPIs. We are having more frequent interactions with the companies, in most cases twice a month. Transparent and early communication is the key to success in this relationship, and this is what we plan to do.

If you are an entrepreneur, remember that funding environment does impact you a fair bit. Whatever people might say, you do not want to spend half a year every year, on the road, trying to fundraise and keep the boat afloat. Unfortunately, you do not have much control over this. What is in your control, however, is timing the market on the product market fit, and this is what you should be focusing on. Great ideas and even better execution will get rewarded in good and bad times alike.