The SaaS Tissue

A Singaporean take on the famous SaaS napkin

A Singaporean take on the famous SaaS napkin

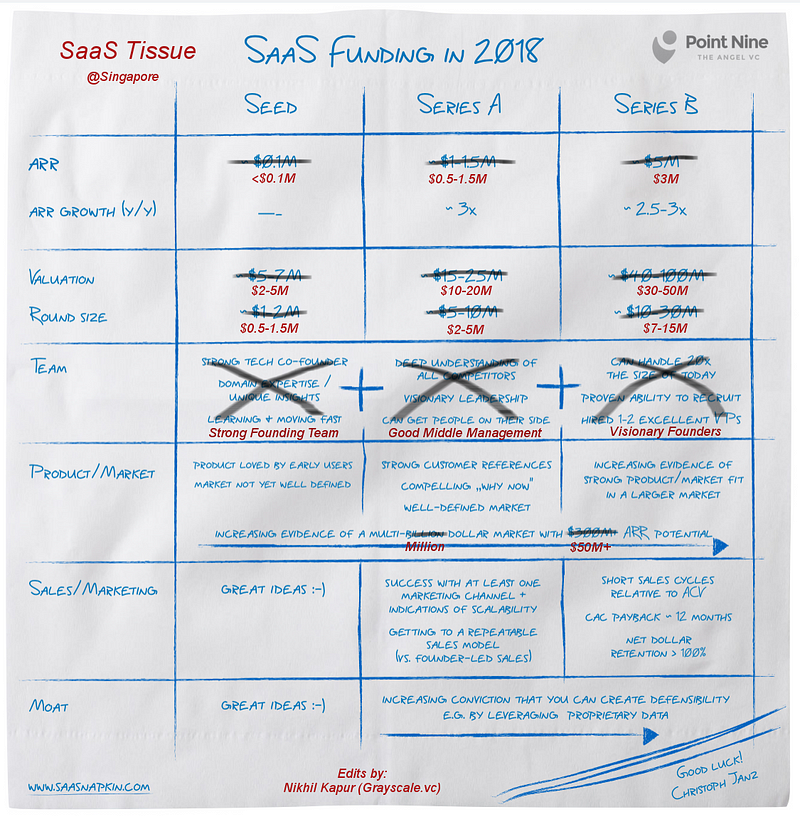

Unless you live under a rock, you’d have heard of Saas Napkin by Point Nine Capital. It’s a back-of-the-napkin table on what it takes to raise capital in a SaaS business and provides a very quick, rough, but accurate guide for founders to figure out metrics they need to hit for future rounds.

I have been asked by a few people for my opinion on the napkin and how I feel things may or may not be different in Southeast Asia. So I decided to convert the famous napkin into a Singaporean tissue and amend the data based on what we see at GREE Ventures.

Note, unlike the napkin where the data is collected through a VC survey, the tissue contains proprietary data only from GREE Ventures database. This is from 30+ pure-SaaS companies, which we evaluated in second half of 2017 and for which we posses accurate MRR, round size, and rough valuation data.

Without further ado, here goes.

A few things will be quite evident after you go through the changes:

- The round size, valuation, and ARR are all a notch lower than those found in US/EU. We are in early days of SaaS in SEA, and it’s very difficult to hit the numbers in the napkin when selling to businesses here

- I have simplified the team section significantly. US/EU is gifted with serial entrepreneurs and the investors can be highly selective in terms of domains and teams. In SEA, strong teams, heavily biased towards first time founders, get picked regardless of whether there are gaps in the team or not

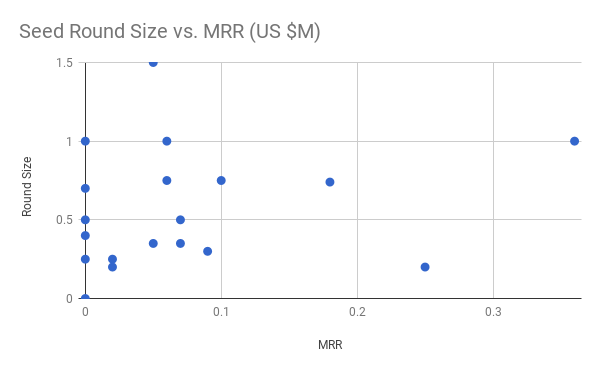

- Seed funding is relatively easier to find in Asia as you don’t need to prove much in terms of revenue except customer love. I know a lot of people will disagree with this claim, so I show data from Seed stage companies that we met in H2 2017 below. All/most of these companies have managed to fund raise and hence the data is quite accurate. You can notice that most Seed rounds have MRR <$0.1M and a fair bit are pre-revenue

Hope this helps you rethink if you were planning to simply follow the SaaS Napkin and apply it to SEA context. In case you are a founder/investor and disagree with the numbers above, do shout out in the comments section below and I’ll be more than happy to edit the Tissue!