Transitions in a VC firm

And introducing the newest member at GREE Ventures

And introducing the newest member at GREE Ventures

This week I wanted to talk a bit about dynamics of a VC team and how VC firms think about hiring, transitions, and change. Venture Capital as an industry has VERY long term horizons with each fund looking 10 years into the future. Every 3–4 years when the firm fundraises, the partners have to commit to 10 more years of staying involved to manage the portfolio. Just like the business, our teams end up growing at a very gradual place rather than bloating in size from round to round like a startup would. With each new fund, depending on the size and management fee, only a handful of members may be added into the team at various levels and given these limited opportunities it becomes one of the toughest industries to get into.

While expansion hiring in a fund is slow, transitions within a firm are more common. Lately, a lot of firms from Sequoia to KKR to USV in the valley have been public about these top-level transitions and what it means for their funds.

At GREE Ventures, we have had our fair share of such transitions. Most folks in the ecosystem still fondly remember the time when Alan Kuan Hsu was leading our fund in Southeast Asia. Looking back at the portfolio he built for us, I feel he has a real knack for investing and picking the right founders and gaps in the market. I joined GREE Ventures as a Summer Associate in 2015 while finishing my MBA and its not too long ago that him and I sat in the Pie office chatting to Pieter and Thijs about team culture. Later that year Kuan decided to step out to start his own fund (KK Fund), and I suddenly had an opportunity to join GREE Ventures full-time. Devoid this transition, I am not sure whether I would be sitting on a Friday night writing this blog post.

While I was getting onboarded full-time and the firm was closing its second fund, Albert Shyy had to step up in the firm to lead Southeast Asia, and so began the next chapter of our fund in SEA. Albert had already spent enough time with the portfolio for the companies to be comfortable with him taking over. In addition he brought a new level of energy into the leadership. His tireless professional attitude towards the portfolio and partnership is anything but admirable. These were exciting times for both of us, we were becoming much more independent in our decision making in Southeast Asia as the partners wanted to let the feet-on-the-ground make the hard decisions. Tasked to enter the India market, Albert and I started making regular trips to the land of Samosas, Dosas, and Garlic Naans, and managed to find our first investment in Flyrobe. We also spent a lot of time strategizing the portfolio creation and fund deployment, given that we now had enough investment and returns data from the first fund.

A year or so in, Albert however decided to move on also. While I will never really know all the reasons behind this transition, I know it was a hard decision for him to make and for the partners to accept. But the transition again presented a window of opportunity for two people. I was now tasked to lead the fund and build a team in Southeast Asia by the partners. And so began a new chapter again.

New Beginnings

I won’t lie and say it has been easy. In fact it continues to be the hardest thing I have done so far in my life. It was easier for me to build a solid team in my previous company because the vision, business, strategy, and tactics were my own, in an industry that I understood well. Venture Capital however is a complex art, and it takes decades to master it. Having complete freedom to mould the fund’s strategy and execution was thrilling and at the same time scary.

I especially spent days and night thinking about every aspect of this team building activity. While in the weekdays I was busy transitioning over the portfolio companies and ensuring the founders that everything in our fund continues to remain stable, during the weekends I was spending my time figuring out the focus areas for our fund and the people I wanted to execute the same with me.

Top of my mind were these questions:

How do you find people that truly align with you and your team’s and your portfolio’s morals and values and beliefs?

We are in People business. Everything we do, from investing to managing the portfolio to exiting, is about building the right relationships and earning the other person’s trust. And this is why having a team that works well together and trusts each other is of utmost importance. Sure there needs to be diversity in the team and different viewpoints, but in the end the culture of new members needs to fit not just with the team but also the portfolio.

How do you find people willing to dedicate their life towards this career path?

It is so easy to get enamoured by the Venture Capital industry and also so easy to use it as a stepping stone for (seemingly) better pastures. It is imperative that any new member joining the team views it as a long term career option and not just a good gig before the next best job is offered to them.

How do I disassociate myself from a few portfolio companies, companies that are almost like children to me?

Not that I know what having a child means, but I can at least guess. A good VC cares for her portfolio companies, supports them to take their first steps in the business world and oversees them growing up to adulthood. If she needs to part with them while they are still teenagers, not knowing whether they’ll survive the cruel world, it’s harsh.

These questions kept me awake many a night. As I mulled them over and was starting to have clarity on my next steps, a new change was around the corner.

Enter Samir

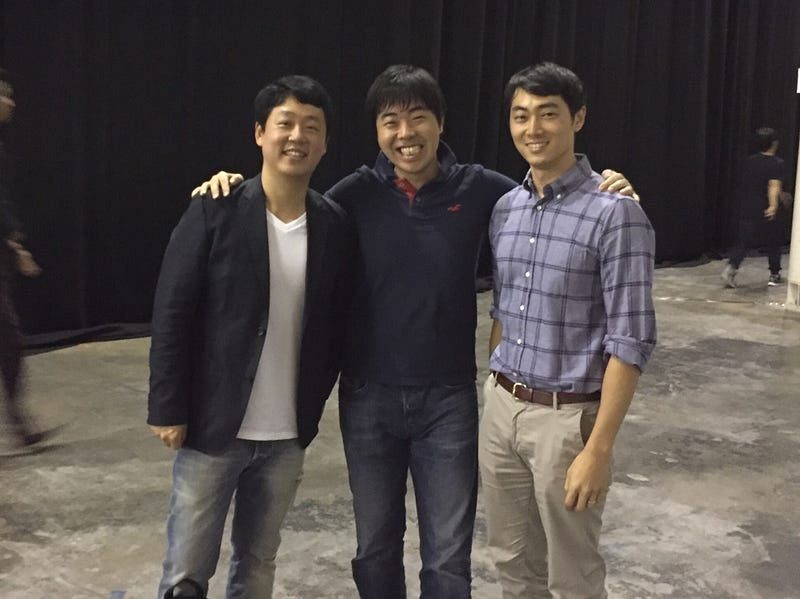

Samir Chaibi, had done his summer internship with us last summer. He came to us while finishing his MBA at Wharton and having experience leading finance at a Bio-engineering startup in Boston and running his own legal docs startup in the Middle East. A founder/entrepreneur with previous experience in Private Equity and Investments willing to come back to the Investor side is a rare breed, and we loved the way he worked with our portfolio company Healint during his short summer stint with us.

As I thought more and more about this, I became convinced that he was a good fit for our team. When I learnt that he was interested in coming back to Southeast Asia post his MBA, I decided to take the leap of faith and recommend him to the partners. Fast forward three months, and he was packing his bags to join us in the summer.

Three months in and I can’t be more happy with how things stand with him being part of our team. He has quickly taken over control of our internal processes, and is spending numerous hours in Indonesia for us, our most important market outside of Japan. But more than just his execution capabilities, there are a few qualities that make him an exceptional candidate for us. These qualities are also what I am starting to qualify as the true DNA of our team’s culture.

1. Founder empathy

Surprisingly, this is hard to come by in this region. I feel it’s to do with the fact that most VCs in the region don’t come from an entrepreneurial background and are not capable of feeling the entrepreneurs’ stress. Samir does an amazing job at this, understanding the thoughts and feelings of our portfolio founders.

“I really do appreciate the well articulated questions and the intimate knowledge of our business.” — Founder after Pitching to Samir

2. Pay It Forward

Something we have actively followed in our fund since eternity. Whenever we meet a founder for a pitch, we and now Samir, are always willing to go out of our way and open our network for them. Given Samir’s time spent in Middle East, US, and SEA, he enjoys a broad network that comes in really useful.

“Hey Samir, thanks for this! Really appreciate the effort you put into modelling the tiered plans” — Portfolio Founder after Samir’s recent “Value Add”

3. Obsession

Mark Suster wrote this brilliant post on finding Obsessive and Competitive Founders. I take it a step forward and claim that for VCs to succeed, they need these same qualities in the DNA. We as investors need to have this same level of obsession and intensity towards our work as we expect our founders to have towards theirs. Like Suster, I am not saying this needs to come at a cost to your health or time spent with your loved ones, but I do realise that I and others in my team will have to give *something* up to be able to pursue this career properly. Samir, has again shone on this, all the way from his extreme responsiveness regardless of the night’s time to his tireless trips to Jakarta almost every week.

4. Feedback

The last quality which I feel defines a good team is bi-directional transparent feedback. Being open to taking criticism and praise, and being forthcoming in your own feedback towards others is an extremely important requirement for a healthy relationship. And we are both working on putting the right structures in place to be able to do this.

This month is Samir’s wedding in Bogor (Indonesia), so if you know him (or not), please send him your best wishes. I also send my heartiest congratulations to him and Nasreen through this post. As I write this out, I know I’ll sleep more peacefully in the night knowing he is a core part of our team.