Unboxed VC

Things to know before raising your VC round

Things to know before raising your VC round

I spent most of yesterday at the wonderful Plug and Play office in Jakarta, Indonesia. The accelerator/incubator just began its first batch and I had a chance to share with the cool teams there how a VC looks/analyses/does DD on a startup and also five hacks/tips to keep in mind when fundraising. The full deck I presented has been uploaded here, but I’ll bring out a few key highlights here, for those who missed the talk and are still interested.

The topic of the day was what do VCs look at when investing in startups. Obviously a very generic topic and one that has been covered many many times. As a result, although I covered a bit of the basics as this was an accelerator with very young and early stage startups, I also tried to give away some pointers on what to remember when meeting VCs.

Fundraising Environment

I wanted to set the tone right for the startups by mentioning that the fundraising environment in Asia is quite slow for the last few quarters. I wanted to clear the bad air out of the way, and highlight to the teams that it is even more important now to go well prepared into investor meetings as cheques these days are hard to come by even at an early stage. That said, every hurdle is a window of opportunity and that’s how a startup fundraising today should think of this.

Whether to raise VC

Startups these days truly believe that there is only one way to build a company, raising Venture Capital. Infact VC, is just a part of the journey for very few startups, most of them end up financing the cash flows through other ways. It’s important to figure out the expected trajectory of your business and choose according to what your company needs and not what the tech media market celebrates as a successful company.

Venture Capital is most relevant for breakout companies with high growth trajectories and longer time for breaking even (blue line). If your cash flow is going to be only slightly in the red for a short period of time, you are better off bootstrapping or using some sort of a debt instrument. A combination of the two is in fact ideal where you can build the company till a particular stage and then raise Venture Capital, diluting yourself less and still going after an opportunity for exponential growth.

Areas of Consideration

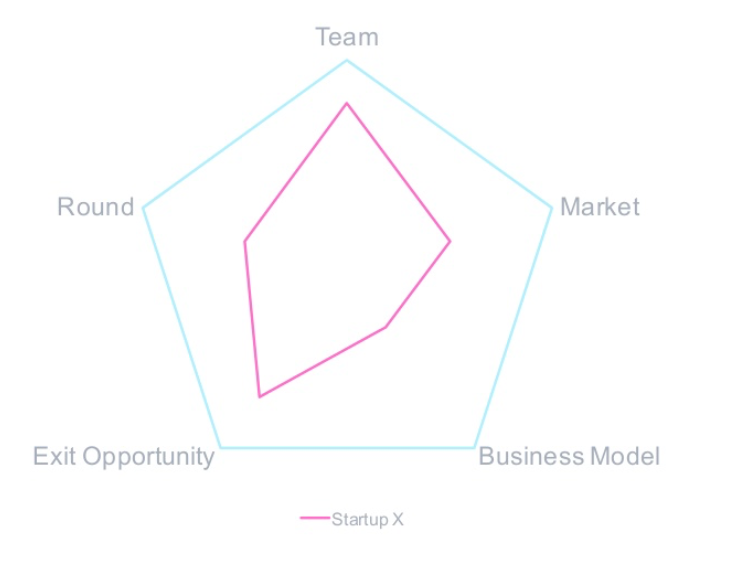

At GREE Ventures, we follow a very simple model for initial analysis of the companies, split into Team, Market, Business Model, Exit Opportunity, and Round specifics.

Team

Enough has been said about how early stage investors care most about the team they are investing in. This is because businesses can change and smart people are able to pivot and rebuild quickly. Obviously, for us as well, the team is the most important characteristic in the deal. This involves founder backgrounds, is this the best team going after this problem, what’s their USP and contribution to the company, and lastly but most importantly, how well do we see us working together. There are multiple posts I can write just about the team analysis but for this time, this should be enough.

Market

In terms of market, we obviously come up with a number for the serviceable and serviced market size, both by a top-down approach and a bottom-up approach. While top-down approach requires breaking a bigger sector into multiple smaller subsectors and estimating its size, bottom-up usually requires estimating the potential customer base and multiplying with potential annual value of the customer.

It’s important to size the market, and make sure it’s large enough. What’s a large enough number usually depends on the size of the fund you are trying to raise from as their fund size determines what should be the potential exit valuation of the company. To give a perspective, a $200M fund will want your company to be worth at least $1B at the time of exit (assuming 20% ownership at liquidity), for it to get the fund returner (or 10x+ return). This means that for a sector seeing 2x revenue multiple, the market should be at least $0.5B for you to be talking to this particular fund.

But what’s even more important than market sizing, is market timing. While the market might be big enough in the future, if the future is too distant for this solution, then now might not be the best time to start the company. There is no hard science in detecting when the market is ready, but a few macro indicators are always good to look at. Also, while competition in market is always a concern, if the market is big enough, we are usually fine with investing in taking on the competition directly or indirectly.

Business Model

This one is the most obvious and the most talked about these days. Business model covers everything from your pricing, monetization and costs, to your unit economics. We also like to see how such business models have evolved in other markets to get some feedback on whether your particular market will evolve the same way. Lastly, unit economics is the buzz word these days, but it’s good to understand what that really means. You can read my post on measuring your CM and Payback Periods here.

Exit Opportunity

Given that we are in an emerging market, exits are always hard to come by. We have paid close attention to where the exit will come from for each company. This strategy is usually not very prevalent in mature markets such as US, because in that market as long as you do things right (or almost right), and are able to scale, you will find an exit path due to healthy M&A and IPO market. This is not the case for Asia, and hence at least spending some time thinking about where the opportunity will come from, if M&A who is likely to acquire such kind of a company and at what final price, really helps us understand whether the price today is justified for us.

Round Specifics

Every fund has its own preferred strategy of investments. Usually it starts with whether they want to be an Active fund (smaller portfolio, more time spent per company) vs Passive fund (larger portfolio, platform style support). It then boils down to the cheque size and stage of investment. If the round in discussion is not in the ballpark of cheque size and stage that we like to invest in, then we just pass on the opportunity. A question came up on whether we are willing to negotiate, and the answer is of course we are, but in the end we have a very good idea whether the round will fall in our bucket of cheque/valuation range.

I then explained why startups should choose their investors as much as investors choose them. I have already talked a fair about this here and here, and hence will not repeat this part.

5 Things You Did Not Think VCs Look At

And now for the fun stuff. Here is a list of 5 things we really do focus on and probably founders don’t think about it.

- Cofounder Relationships

We look for small little cues and facial expressions during the meetings with the team to predict potential rifts between cofounders

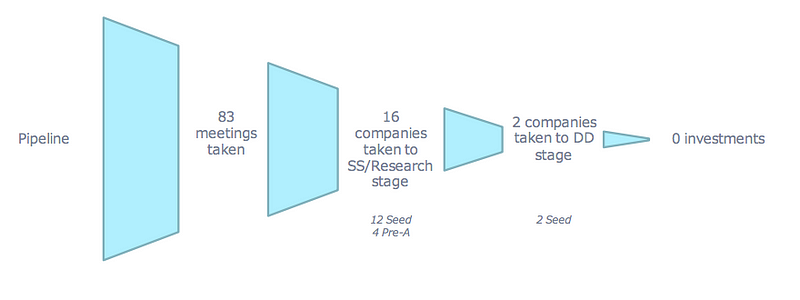

2. Pipeline Funnel

We have a funnel for our customers (startups) just like you do.

Your task is not just to be a good company for a VC to look at but to be the best company they would like to invest in from the whole pipeline

3. Social Media

This one is a bit controversial maybe, but I do like to take a look at your social media account and see how you behave in public on social. It helps me understand what kind of a person you really are and whether I’ll enjoy working with you.

4. Unit Economics and other numbers

We do our own calculations for the numbers you present and if they don’t match with what you have presented, it’s not a great sign. Make sure you present your numbers as they are, rather than hide or ignore stuff. I pay keen attention to what has been said in the deck but even more so on what has not been said.

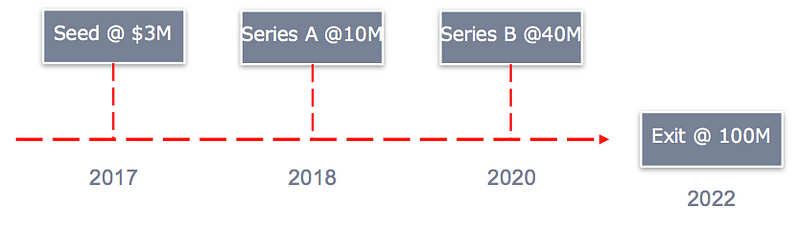

5. Trajectory

We like to chart a trajectory for the startup before we invest, to make sure that we’ll be aligned always. This is a good exercise for us to be prepared for the next steps and have a good gauge on how much time do we have for experimentation and when do we really need to start executing on a certain strategy. For the sake of an example,

I hope this was helpful for the PnP batch to learn a thing or two about the murky VC waters. In the end, fundraising is just a milestone in your journey and just a means to an end. And for some startups you can just bypass this milestone and run on your own. Choose for yourself which path you want to take and choose wisely.