What a VC Stack looks like

And how we stay on top of our game

And how we stay on top of our game

As some of you might know, I started my career as a developer and went on to become a hustling, bootstrapped, ramen-founder (to be precise a neighbourhood-stall-tea-drinking founder). These experiences taught me how to use technology to increase productivity. Or so I make myself believe.

When I entered the Venture Capital sector I realised that even though we VCs invest at the forefront of technology and hope for technology adoption by customers, we ourselves are very slow at tech adoption. A big signal of this is in the way a firm manages their pipeline deal relationships.

When a deal walks through our doors, and walks out an hour later, we need to get back to them within a definitive time. When they come back 6 months down the line with the numbers we asked them to achieve, we better have the old numbers written down some where. But not many do this, especially in Southeast Asia. Most VCs go cold on the founder without any revert, leaving the founder mulling, over cheap beer and chicken rice on a Friday night, where their process stands. If you ever tried to push a file through an Indian government office, it feels the same way.

This is something I have tried to sort out within our fund from day one, and while genuine intention and motivation for doing this is a necessity, what is also important is to use technology to keep track of your deliverables. And so I have sought slowly but surely to adopt tech within our firm to help us do our job better. My goal is to eventually build a simple yet highly productive VC stack, and I share our current stack here.

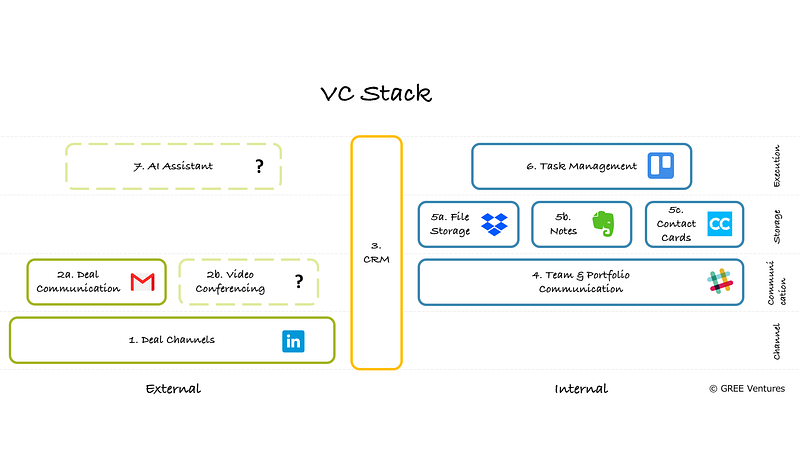

GREE Ventures VC Stack

- Deal Channels: It all starts with how the deal enters our pipeline. For a cold call, usually the answer is through our own website (yes we read every message dropped on our website), LinkedIn, or any other social media. This is easy to setup and most funds enable this piece well because they know we lose 100% of the deals we do not see.

- Deal Communication: We use Gmail for all external written communication. It’s free (or almost free), easy to use and setup, and very performant. No surprises here as well. The entering deal usually moves to a video call. However, we are yet to choose a favourite tool for this. Last year we were using Appear.in and Rebtel (for voice calls), this year we have been using Zoom in a few cases and it has worked well.

- CRM: Post mail, the deal starts interacting with our recently installed CRM. While we were using a Google sheet as our makeshift CRM till late last year, starting Jan 1, 2018 we moved to Hubspot. It doesn’t break down as you go into 1000s of leads, helps us keep track of the pipeline better, helps track pipeline tasks, and collaborate much better with each other on a centralised platform.

- Team Communication: This is when the deal starts moving internally. And the basic layer of our internal communication is Slack. As any startup would testify, Slack is great for team communication. It helps reduce internal emails drastically, makes staying connected on-the-go very simple, and overall increases productivity as long as your groups don’t have a lot of banter. We are probably not using Slack integrations well enough, but I see this changing very soon

- Deal Storage: Now this is where things become interesting. We are likely one of the few funds who have somewhat sophisticated storage of internal deal data. Not only do we store all the startups’ files under proper tree-structured folders in Dropbox, we use Evernote to write each and every word we discuss with the companies for future reference. Your pitch, our discussions, our internal meetings, everything is recorded in Evernote. We also use CamCard to scan and store business cards under proper categorisation for every person we meet, be it deal or investor or media or LP and then connect it to our CRM. It helps us spam you better :)

- Task Management: Once a deal enters our Hubspot pipeline, we open Trello entries on each other to manage specific work items such as further research, metrics review, internal memos etc. Trello is very useful in keeping track of what each team member is doing on a daily basis

- AI Assistant: There is a case to be made that given the volume of emails we handle and number of meetings we schedule, an AI assistant can help us become much more performant in our deal related tasks. We have tried the likes of mimetic.ai and kono.ai for scheduling but they have done more harm than good. I am waiting for the day that these AI models are trained enough on others’ data before we start implementing internally.

Running a fund and managing a pipeline of thousands of deals every year across four geographies with a team of 8 people is not an easy task, especially when we are always traveling. We are evolving our tech stack as we go along, but these 8–10 tools that we use on a daily basis help us be a better VC and get back to the founders faster.

If you are an investor reading this, what’s your stack?