What you’re doing wrong when approaching a VC

And an example of a mail you should never write as a founder

And an example of a mail you should never write as a founder

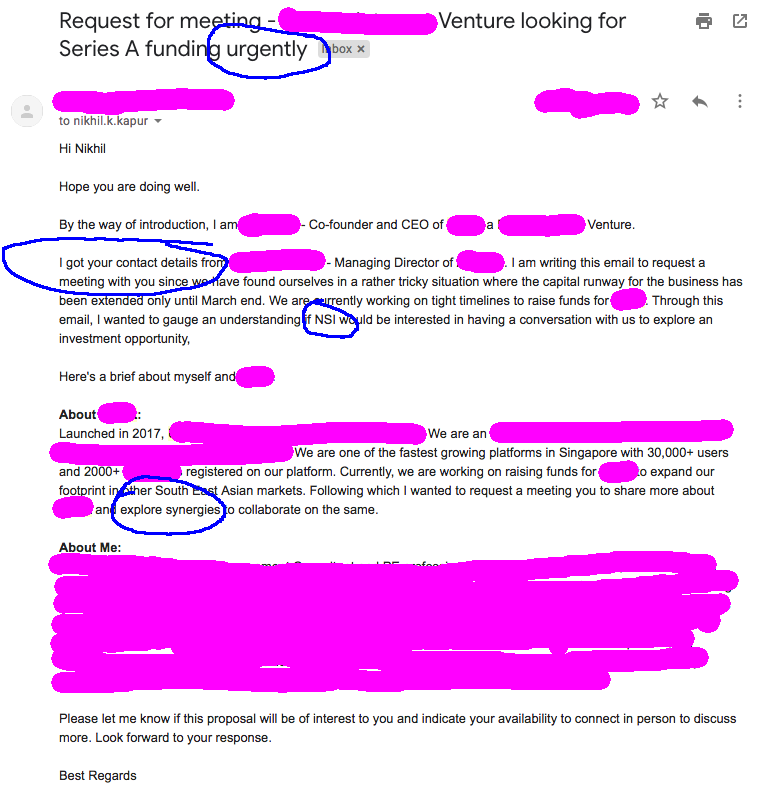

A few days ago I was discussing a cold email I received from a founder. Sorry to say this, but it was probably one of the worst cold pitches I have ever received. Not just because the content was bad, but also because the founder did quite a few basic things wrong, biggest of which was forgetting to change the VC firm’s name when copying-pasting email text 🙈.

I decided to use this particular mail and segue into the following part.

10 thing you should keep in mind as a founder when reaching out to a VC

- Get a warm intro, refer to the person and keep them in CC or get referred directly by email

See Circle 2 in the above email. If you are referring to some one who I know, make sure you put them in CC or ask them to initiate the conversation. The way its done here portrays either laziness or lack of relationship with the referree, both of which are bad for your case. - Address the email to the right person (Nikhil Kapur) and the right fund (GREE Ventures)

As you can see from Circle 3 above, NSI is a popular fund in the market. @Openspace team, if you are reading this, take a bow and clink a mug or two 🍻 - Push me to take an action

Give exact next steps (“let’s jump on a call”, “grab coffee next week”) and give me a reason to take that action. Please save the consultant’s jargon of synergies and collaboration and partnerships as in Circle 4 above. You are asking for money. I am looking to take equity. Yes this is a partnership, but first and foremost its a business transaction, so treat it like one. Also, the urgency shown in Circle 1 is a big no-no. VCs don’t fund a company because the founder is desperate for money and the company is at the end of its runway. We fund companies that we see future or unappreciated value in, and its your responsibility to show us where that value lies. - Don’t send an essay as an email. But a short context is appreciated

The email above has actually done a good job at giving context and a short introduction. Do not make it longer, save some for the conversation. - Attach a short deck

Please do not send a 50 pager word-doc, a 10–15 slides presentation with big font size is sufficient as an initial deck. Do see Guy Kawasaki’s 10–20–30 rule if this is your first time creating a deck. There is more than enough information online on how to create good decks. - Send PDF as attachment

Maybe it’s just me, but I hate to see .pptx format attached as a deck. I don’t want to see which stock photo website you copied your pictures in the deck from. Your deck should be uneditable and should open easily on my mobile. No dropbox links, just plain old PDF attachments, while making sure to keep the size of the deck to as minimum as possible so I can read it quickly while on the move. - Within your deck put an Exact Amount you are fundraising

This helps me understand whether your round size fits my investment mandate. Also, do not put a range for your fundraising amount. It usually means that even you are not sure of what to do with the larger amount of money. - Do your homework

Know who are you talking to. See what investments I have made and mention specific ones that might be related to your company, to show me you took the effort of going through our website or my LinkedIn. This was not done at all in this email. - Reminders of the Past

If we have met before and I passed on the investment last time, remind me when we met, what we discussed and what was the reason I gave for passing on the deal. Pick up the old thread, don’t start a new one. This company had actually pitched to us before, but the founder started a completely new thread (possibly due to a change in management). - In the meeting, bring your co-founder and take notes

When you finally come for the pitch meeting, notice my reactions to each part of your pitch. And ask your co-founder to jot down furiously any specific comments or questions. Refine and iterate your pitch later based on this feedback.

Look, I know its hard to be a founder. Fundraising is especially hard. But this does not give you immunity from writing unprofessional emails, and approaching VCs in the wrong manner. I hope you can keep these simple things in mind to significantly increase your chances of a successful fundraise.